What is a Lifetime ISA?

Say hello to the Lifetime ISA! Just like its ISA siblings, it's a trusty 'wrapper' shielding your investments from pesky taxes on interest, income, and capital gains.

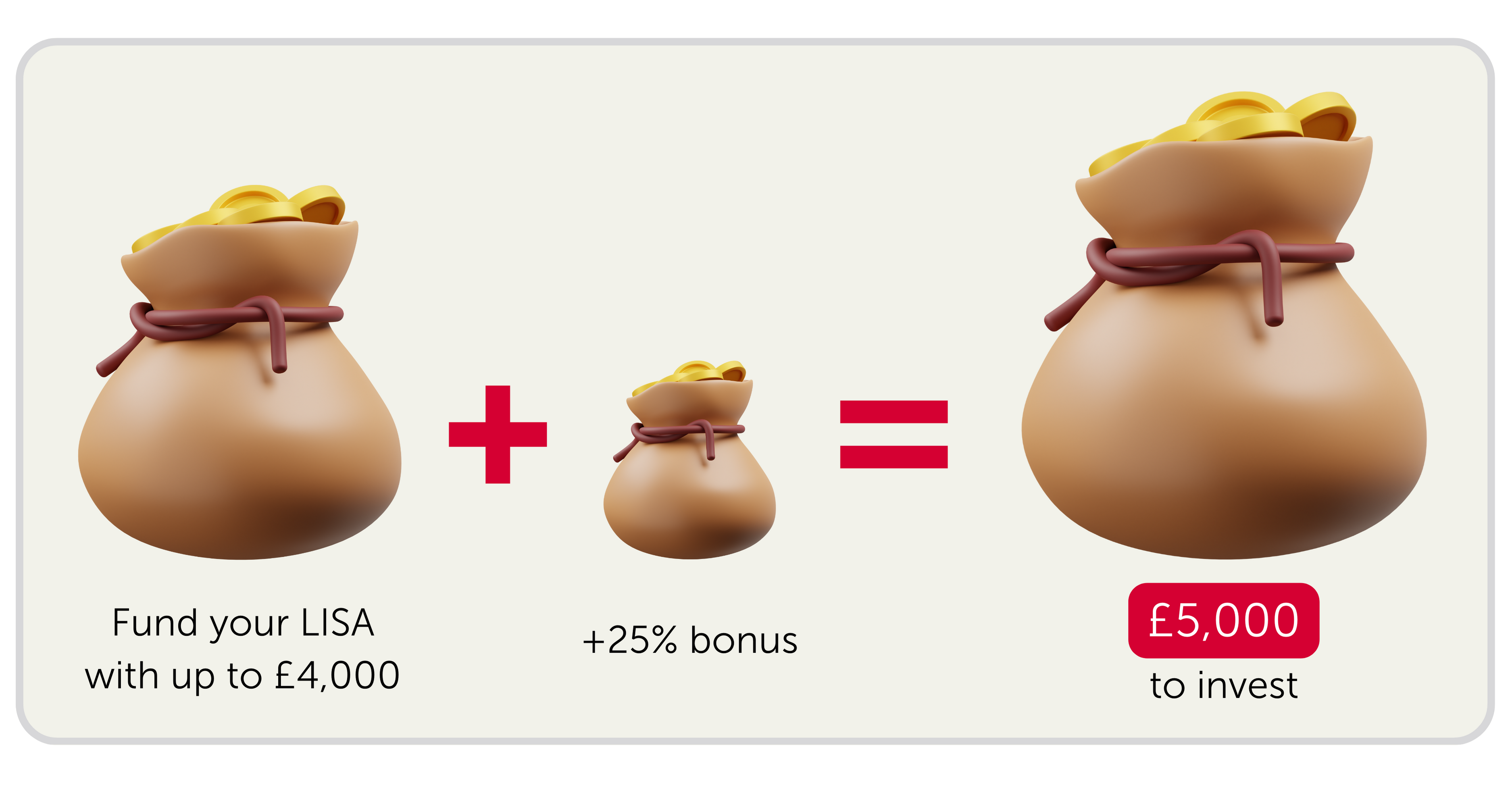

As a member of the ISA family, your Lifetime ISA counts toward your annual overall ISA limit. For the 2025/26 tax year, that limit clocks in at a cool £20,000. So, if you manage to put away the maximum £4,000 in your Lifetime ISA, fear not – you've still got a hefty £16,000 to play around with in one or more of your other ISAs.

Arguably the coolest thing about the Lifetime ISA is the 25% bonus that the government kindly adds on top of all your contributions, but more on that later…

Is the Lifetime ISA a financial match for you?

If you’re 18 to 39, dreaming of your first home, or planning for retirement, then the Lifetime ISA might be for you.

For every £4 you save, the government adds £1, offering an annual bonus of up to £1,000. The bonus applies every year from when you turn 18 until your 50th birthday, allowing you to uncover the potential of £32,000 in free money.

Just beware of the 25% government withdrawal charge if you’re using the money for something other than your first home or after turning 60. The charge would apply to everything in your account, meaning you could get out less than you put in.

And as we’ll see, when it comes to using a Lifetime ISA as a pension alternative, it's worth giving it a good think, especially if you're already rocking a workplace pension or pulling in a tidy income.

So, is it a match? That’s the £32,000 question this guide will help you answer.

Can I open a Lifetime ISA?

If you're 18 to 39 and a UK resident, the door to the Lifetime ISA is open. Keep the contributions flowing until you're 50, even if you're approaching the big 4-0 and you still haven’t opened your account. Fear not, late bloomers – a minimum deposit of £100 or a monthly payment of £25 keeps the government bonuses flowing. Just be sure to make your first payment before your 40th birthday.

Investing choices unveiled

What's in the investment toolbox of your Lifetime ISA? With AJ Bell Dodl's Lifetime ISA, you can choose from a rich array of shares, funds and themed investment trusts to shape your portfolio.

How much could I save?

- Fill up your LISA

- Leverage tax free growth

-

Taking out that money

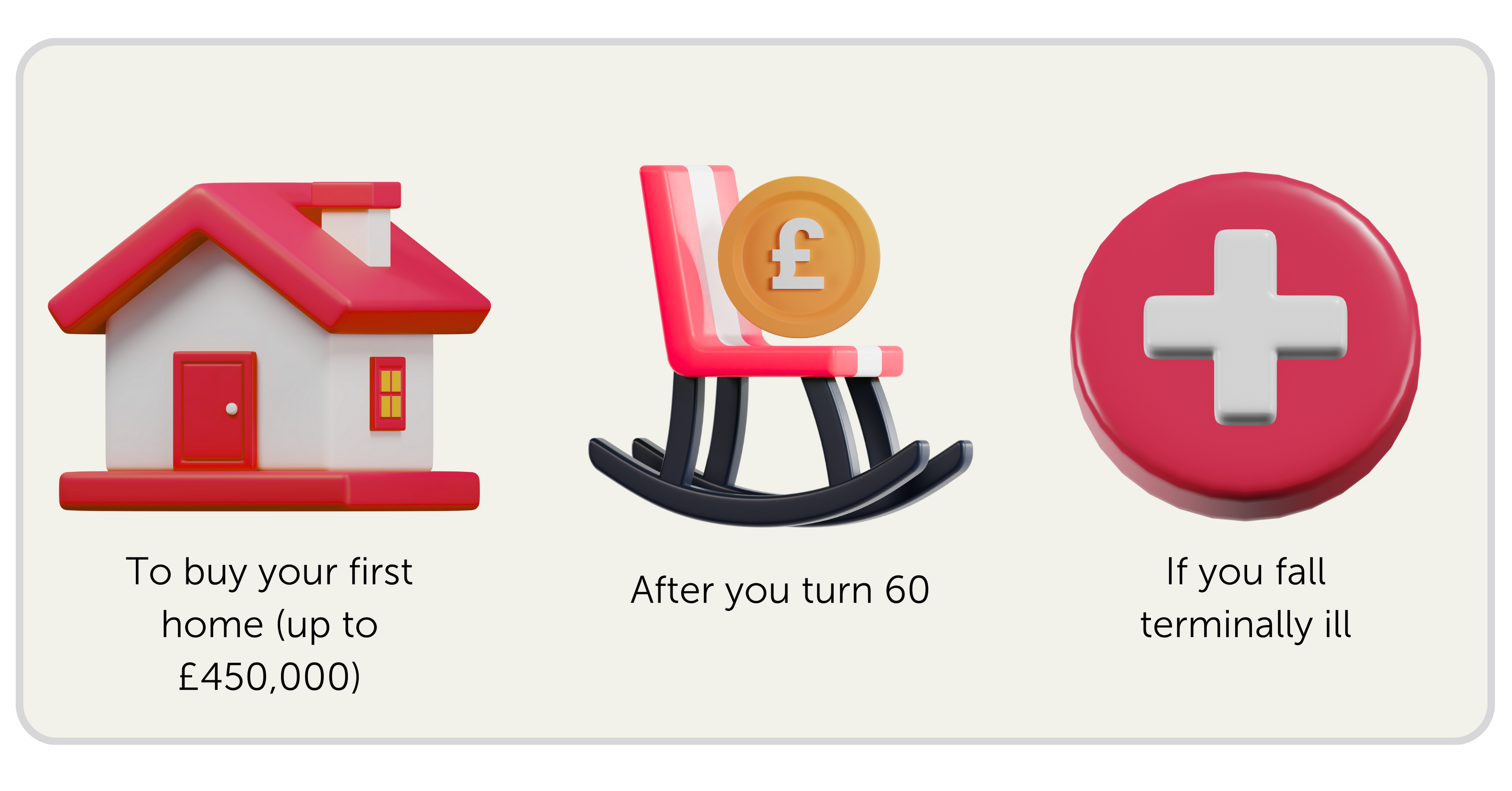

There are only three situations that allow you to take your money out without incurring that pesky withdrawal charge.

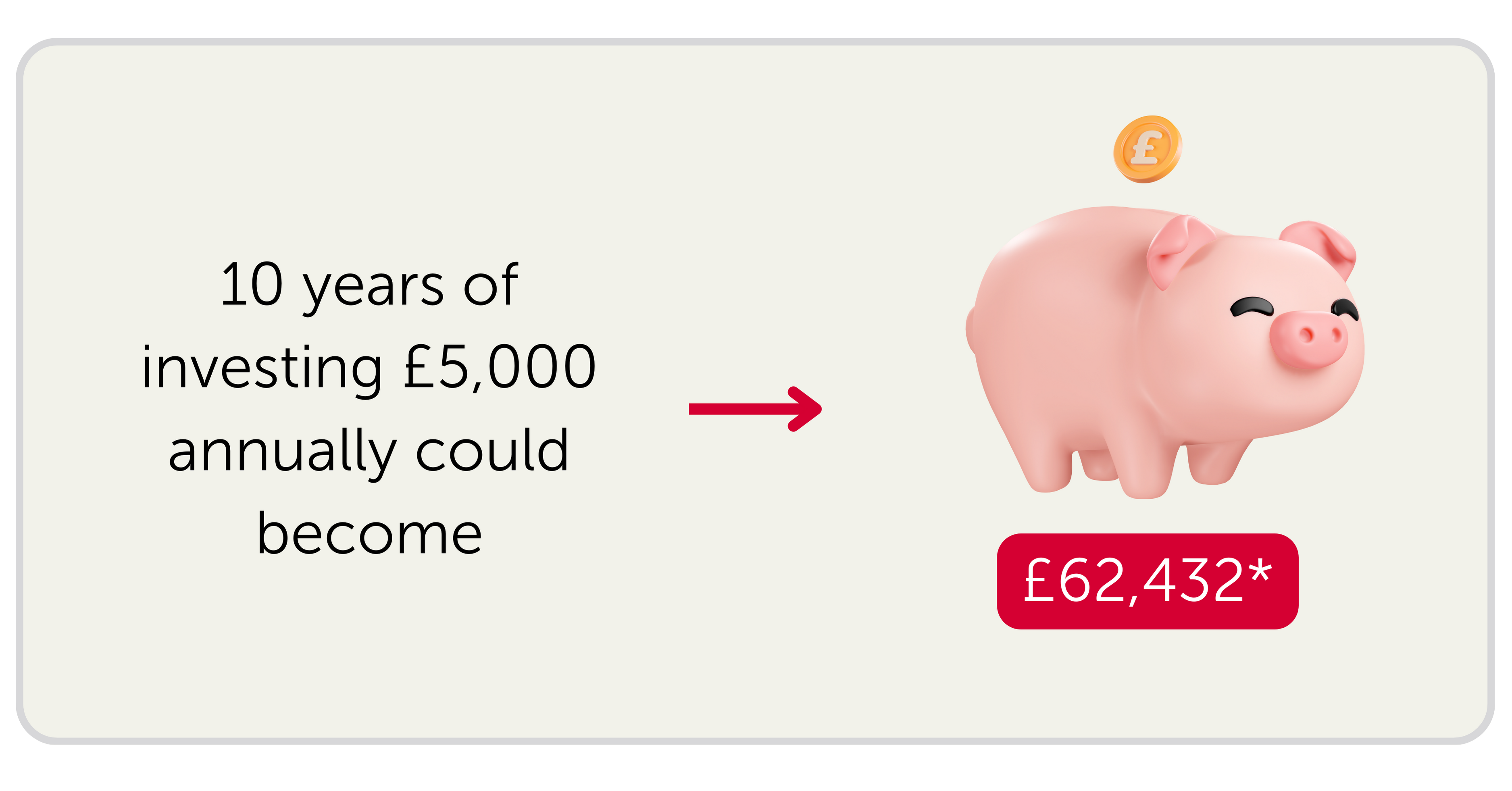

*This assumes a 4% investment return each year after charges. The FTSE All-Share has returned 9% a year for the past 10 years including dividends.

When is the government bonus paid?

You're probably wondering when that extra boost from the government will hit your account.

Well, here's the lowdown: we’ve already established that you can expect a 25% bonus based on what you contribute to your Lifetime ISA, and the max you can receive is a sweet £1,000 per year. This bonus is solely based on your contributions, not on any investment growth or interest. And guess what? You have the freedom to invest those bonuses wherever you fancy.

In terms of when, usually you'll receive your Lifetime ISA bonus within 4 to 9 weeks after putting that money into your account.

Diving deeper into the government withdrawal charge

Ah, the dreaded LISA withdrawal charge – let's get into when it kicks in. As we’ve seen there are only three situations where you dodge that 25% government withdrawal charge. Firstly, buying your first home, secondly after you hit the big 6-0 and finally, on a much less positive note, if you find yourself in the terrible situation of facing a terminal illness.

Bear in mind that the 25% charge applies to your total withdrawal, meaning you're not just kissing goodbye to the government bonus but also your own hard-earned cash.

To put that into perspective, let’s say you stash away £1,000 in a Lifetime ISA, earning you a cool £250 bonus. If you decide to withdraw the £1,250, brace for impact – your government withdrawal charge would be 25%, clocking in at £312.50. Ouch. So, you'd walk away with just £937.50, or 6.25% less than what you put in…

Given this hefty penalty, the Lifetime ISA might not be your cup of tea if you're not keen on locking your money away until you buy your first home or enter your golden years.

Buying your first home

Dreaming of that cosy abode to call your own? You can dip into your Lifetime ISA without facing the dreaded withdrawal charge if you're using it to buy your first home. Here’re the conditions:

- Your first home must be in the UK, worth £450,000 or less, and the only home you own.

- It's got to be where you intend to live, not a buy-to-let.

- You'll need to use a mortgage to seal the deal.

But hold up – your LISA needs to have been open for at least a year before you can use it for your first home. And another nugget of wisdom – if you're eyeing that dream home within the next three years, a cash LISA might be your best bet. But if you're playing the long game, consider an investment Lifetime ISA for potentially better returns.

When you take money out of your Lifetime ISA to snag that humble abode, it's not going to land directly in your pocket – we'll send it straight to your solicitor or conveyancer. This cash is marked specifically for buying your first home – nothing can go towards fancy furniture/fittings or solicitor’s fees. It's all about securing that roof over your head, no extras attached. And you'll need to draft in this solicitor/conveyancer to guide you through the process.

Also, if you're buying with a fellow first-time buyer you’re in luck, because both of you can tap into your Lifetime ISAs and score that sweet bonus.

Planning for your golden years

So, you're checking out that sweet 25% government bonus in your LISA and wondering if that’s your ticket to a blissful retirement. Well, let's break it down.

The Lifetime ISA sure packs a punch with its tempting bonuses, making it an attractive option for retirement savings. But how does it stack up against the pension? Buckle up, because it's a bit of a mixed bag.

A Lifetime ISA, broadly speaking, works best as a sidekick to your pension, offering another nifty way to stash cash for your golden years. However, pensions come with their own perks, like 'free money' from the taxman and even your employer. So, ditching your workplace pension for a Lifetime ISA might not be the way to go...

But don't write off the LISA for retirement just yet. There are scenarios where it might shine brighter than a pension. It's all about finding the right fit for you.

What might make a pension more suitable?

- If you're working, your boss might chip in extra cash, which you'd miss out on with a Lifetime ISA.

- Pensions give you tax relief, and higher earners bag even better deals.

- You can dip in to your pension savings from age 55 (57 from April 2028) and keep adding cash, while Lifetime ISAs lock up your dough until you hit 60 with a strict no top-ups-allowed policy after 50.

- Your current and future entitlement to means-tested state benefits may be affected, whereas savings in a pension are only taken into account once you reach state pension age.

What might make a Lifetime ISA more suitable?

- If you need money in a pinch, a Lifetime ISA lets you access your stash early, but only with that 25% government withdrawal charge.

- Once you hit 60, Lifetime ISA cash-outs are tax-free, unlike pensions that get nibbled by the taxman.

- If you're your own boss, you can stash cash into a Lifetime ISA whenever it suits, no strings attached.

- If you're a big earner nearing pension caps, you can keep squirrelling away in a Lifetime ISA without hitting any pesky limits.

Important to know: A Lifetime ISA is not for everyone. If you withdraw money before age 60, other than to purchase your first home, you will pay a government withdrawal charge of 25%. This may mean you get back less from your LISA than you paid in. Also, if you choose to save in a Lifetime ISA instead of enrolling in, or contributing to, your workplace pension scheme you will miss out on the benefit of your employer’s contributions to that scheme and your current and future entitlement to means tested benefits may be affected. This article is based on ISA and tax rules of 2 February 2026. These articles are for information purposes only and are not a personal recommendation or advice. If you have any questions, get in touch through the Dodl app.

🔔 Remember, investing carries risk and nothing in this article should be taken as advice - Dodl doesn't give advice, but we do hope the info is helpful!