With government top-ups of up to £1,000 per year, this handy financial tool can significantly boost your ability to purchase a property (valued up to £450,000) or support your savings for your golden years (after 60).

From £12,000 to £20,000 in three years

Take Camilla, a first-time buyer, who really made the most of the benefits of her LISA. Starting in 2019 with an annual investment of the maximum £4,000, she saw her savings amount to £20,000 within three years, helped along by smart investments and the sweet 25% government bonus.

Building confidence

Initially aiming to enhance her purchasing power for a more substantial property, Camilla found the government incentives almost too good to be true. She kicked off her investment journey by buying shares in select companies before diversifying her portfolio with funds.

“It might not seem like much, but I think it’s pretty amazing,” says Camilla, reflecting on her experience. I wasn’t aware of LISAs before, and I think more people should be encouraged to open one.”

LISAs not only offer a financial boost for first-time buyers like Camilla but also instil confidence and a sense of achievement as you step onto the property ladder.

The benefits of early action

What’s more, the earlier you get going, the longer your finances have to benefit from the tax perks the Lifetime ISA offers, potentially getting you more quickly towards your end goal.

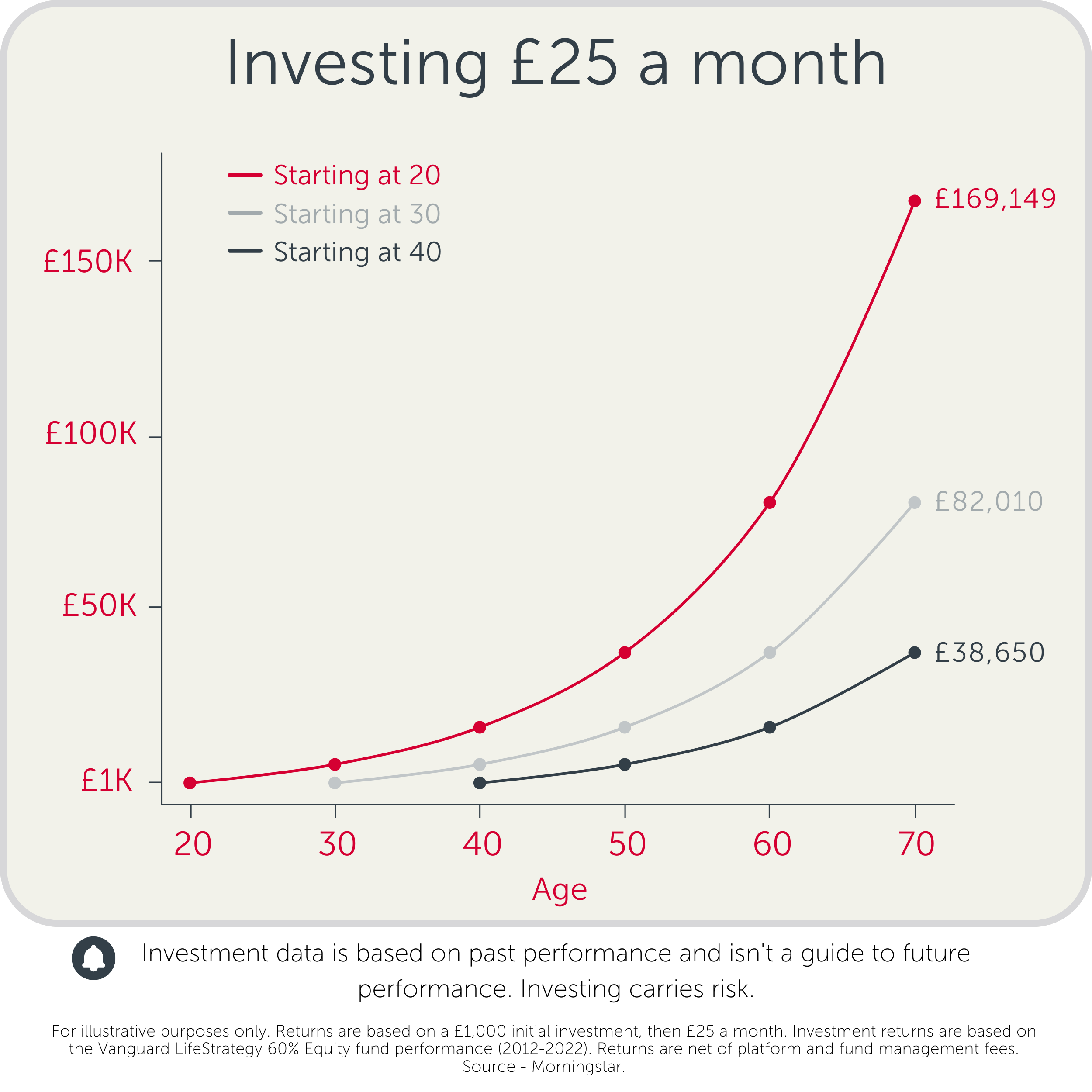

You might think that you need a lot of money to start investing, but that’s not the case. Even modest contributions can add up significantly over time. For example, let’s say you start with a £1,000 initial investment and add just £25 a month.

Over the years, these small amounts can grow into something much bigger. Check out the graph below based on the performance of Dodl’s all-in-one fund (60% shares), that showcases the potential benefit of starting that little bit earlier.

Feeling a little more empowered to take the next step? Add some cash to your account today. You can start with as little as £100, or £25 a month.

Read more in our:

🔔 Investing involves risk. Nothing in this article should be taken as advice - Dodl doesn't give advice, but we do hope the info is helpful! LISA rules apply. If you withdraw cash from your Lifetime ISA before age 60, and aren't using it to buy your first home, you’ll pay a 25% charge on the amount you take out. That means you could get back less than you paid in.