So you’ve started investing in your Dodl account. That’s great! But have you considered setting up monthly investments?

This is what Camilla did, and following this technique she grew her Lifetime ISA from £12,000 to £20,000 in just three years.

Starting small, thinking big

After she bought her first home, Camilla began investing regular top-ups over the year in a Lifetime ISA to reach the £4,000 saving limit, with the Government adding a further £1,000 each year.

Camilla’s investments were initially only in shares, which to some, may seem like a risky approach. However, using monthly investing and diversifying into funds, she was able to mitigate some of that risk, and her investments grew alongside the government bonus to turn £12,000 over three years into £20,000.

“I don’t think their importance can be underestimated”

Thirty-seven-year-old Camilla now feels more financially secure for her retirement and her regular deposits have set her up for the future.

Why do people opt for regular investments?

By consistently investing smaller sums over time, rather than a lump sum all at once, you benefit from buying fewer units when prices are high and more when prices are low. This averaging out of prices helps reduce the impact of market ups and downs and removes the stress of trying to time the market perfectly.

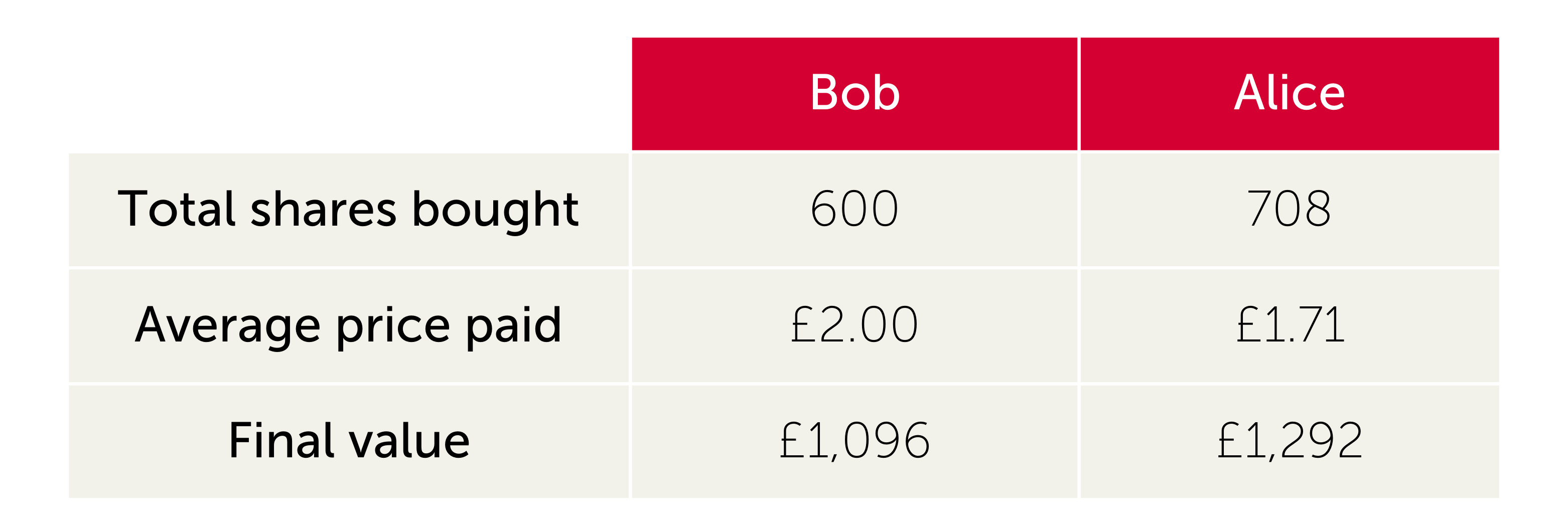

For example, let’s consider two investors: Alice who invests £100 monthly over 12 months, and Bob who invests a lump sum of £1,200. They both start in January. Despite them both investing the same amount, as market prices fluctuate throughout the year, Alice ends up buying over 100 more investment units at a lower average price compared to Bob by the end of the year. So, despite these market ups and downs, Alice’s investment value ends up nearly £200 higher than Bob's.

The Dodl app allows you to make regular payments in just a few taps, with total transparency over your investments. Why not give it a try?

Read more in our:

🔔 The value of your investments can go down as well as up, and you might not get back what you originally invested. LISA rules apply. If you withdraw cash from your Lifetime ISA before age 60, and aren't using it to buy your first home, you’ll pay a 25% charge on the amount you take out. That means you could get back less than you paid in.