What is a general investment account?

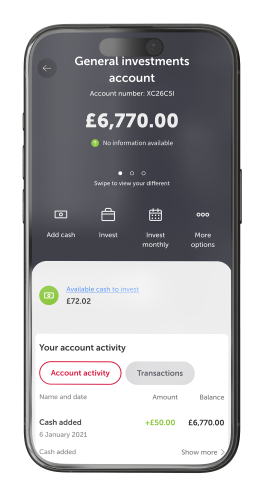

A general investment account (GIA) is sometimes called a dealing account or trading account with other providers. Whatever you call it, it’s a flexible - but taxable - investment account. If you haven't used up your tax-free ISA allowance this year, you may want to look instead at the Dodl investment ISA.

For all the important details about the Dodl GIA, make sure you read its key features.

GIA charges

Like all Dodl accounts, you'll only pay one simple low-cost charge for your general investment account. Here's how it works.

How to get started

It’s as easy as 1-2-3 to get started with a Dodl GIA.

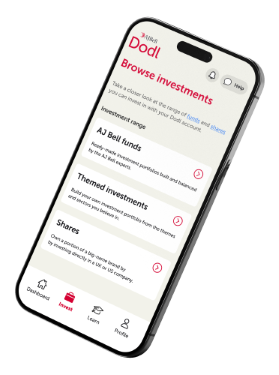

Like what you’re hearing? Download Dodl today to open your general investment account.