Types of investments as a beginner

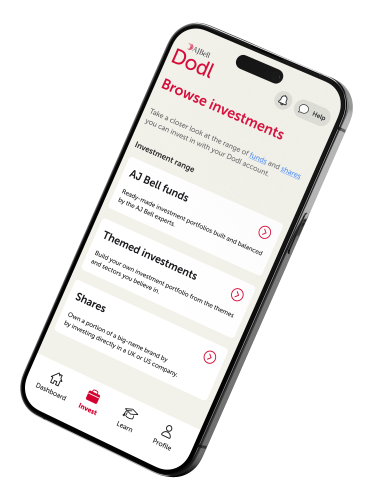

Choosing investments can feel a bit scary, that’s why Dodl doesn’t overcomplicate things. To make your investment decisions easier, you’ll pick from a straightforward range made up of funds, exchange traded funds and shares.

Jargon alert! What are funds, exchange traded funds and shares?

Dodl investment range

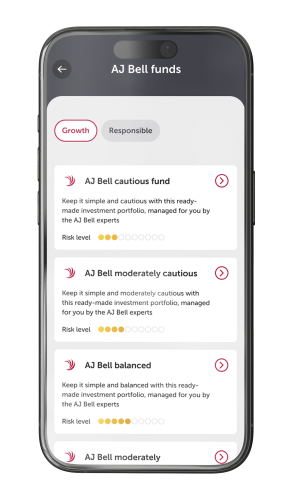

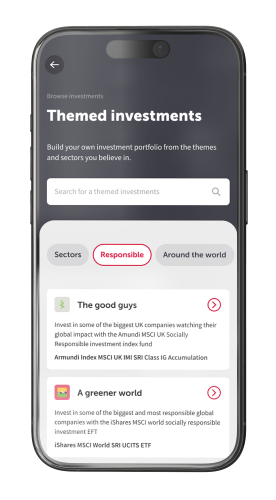

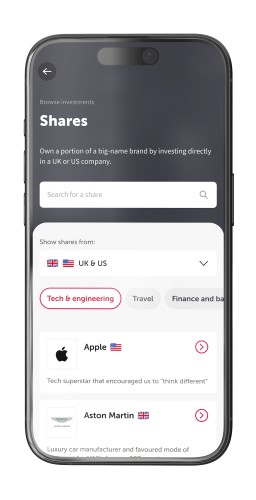

The range of investments can be split into three groups: the AJ Bell funds, themed investments and shares.

Dodl offers a streamlined selection of funds, themed investments and shares from the wider AJ Bell range. If you're looking for more options when it comes to your investments, Dodl might not be for you. Instead, you may want to explore AJ Bell's full range of investment options.

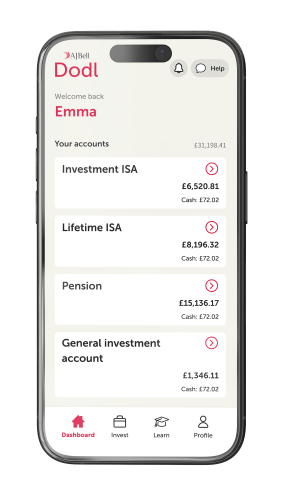

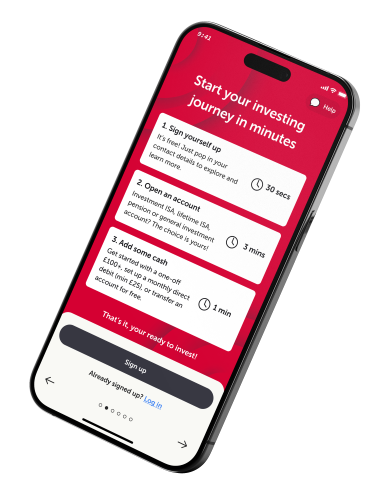

How do you invest with Dodl?

Get started in 3 simple steps.

-

Open your Dodl account

Sign up, choose an investment account then open it – all in a matter of minutes

-

Add cash

Begin by adding as little as £100, or set up a monthly direct debit from £25

-

Start investing

Browse the investment range, read up on the details then start building your portfolio