The Dodl account charge

Calculate your investment platform charges on Dodl

See what a Dodl pension or general investment account would cost you each month.

How the calculator works: It's a projection of the full year charge based on the investment value you enter, then divided up into the monthly charge. Don't worry, you won't be charged until you've invested.

Enter the value of investments in your Dodl account:

Your full year charge would be (0.15% of what you entered):

£0.00

So your monthly charge would be (it's that charge above divided by 12, min. £1)

£0.00

The calculator is a tool to help you understand the Dodl account charge and compare it with other providers. It doesn’t project your actual charges, which’ll likely differ and be based on the real value of the investments in your account each month. It also doesn’t include any investment charges, like foreign exchange charges or stamp duty for shares, or ongoing charges for funds.

How does Dodl compare?

Well, here's a little comparison table we made earlier.

| Investment ISA with... |

Monthly subscription? |

Annual % charge? |

Interest rate on cash |

How it works out for a £10,000 investment ISA (monthly/annually)? |

|---|---|---|---|---|

| Dodl | Nope | 0.00%* | 3.80% AER variable | £0* / £0* |

| Freetrade | £4.99 | Nope | 2.50% AER variable | £4.99 / £59.88 |

| Moneybox | £1.00 | 0.45% | 2.50% AER | £4.75 / £57.00 |

| Chip | £5.99 | Nope | Nope | £5.99 / £71.88 |

| Vanguard | £4.00 | Nope | 1.85% AER | £4.00 / £48.00 |

1. Charges, subscriptions and interest rates based on those published on all providers' websites on 21 January 2026. Charges can and do change so it's best to check websites for the latest figures. 2. Example of annual and monthly charges based on an investment ISA portfolio value of £10,000. 3. Investment charges, e.g. FX charges for shares and ongoing charges for funds aren't included in this table. 4. Freetrade's charge is based on their standard plan, paid monthly. 5. Vanguard's charge is per person rather than per account. 6. Chip’s charge is based on their ChipX plan, paid monthly. 6. Where charges are based on the value of your investments, monthly charges will change as investment values change.

*For 12 months. Open to new and existing Dodl customers that deposit £1,000 (min) into a Dodl investment ISA between 1 February 2026 and 30 April 2026.

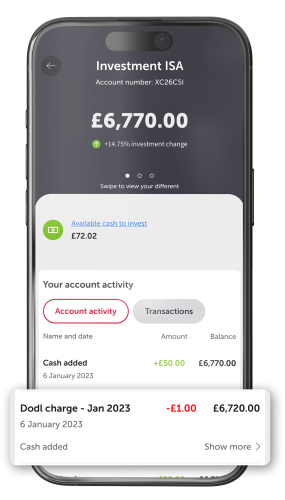

Interest rates on cash

We pay 3.80% AER variable on cash on cash that is not yet invested and is held in any Dodl investment ISA and Lifetime ISA accounts.

That means you’ll be able to earn on the cash you keep in your account while you decide how you’d like to invest – just remember you'll also need some of this cash to cover your account charge.

If you have a pension or general investment account, you won’t earn interest on money you hold as cash.

You can read more about our interest rates on cash by heading to our interest page.

Though they're important to consider, charges aren't everything - make sure the provider you go with offers exactly the products and services you need. And remember, Dodl doesn't do advice, just clear info!