What is a pension?

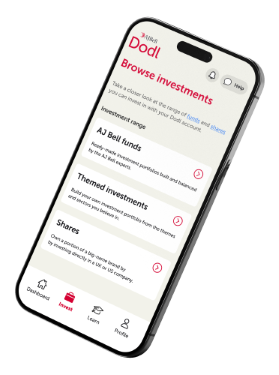

It’s a special type of investment account which lets you save and invest for the retirement you're dreaming of.

How does a pension work?

Know the pension limits

This page covers some of its most important points but before you open a Dodl pension, make sure you read its key features.

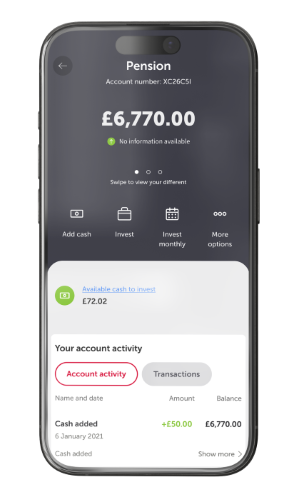

Pension charges

Like all Dodl accounts, you'll only pay one simple low-cost charge for your pension. Here's how it works.

How to get started

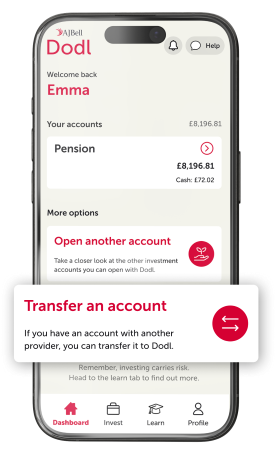

It’s as easy as 1-2-3 to get started with a Dodl pension.

Before you go for it, check transferring is the right thing for you and your retirement goals. Be sure to compare the charges and benefits offered by your current pension provider and Dodl.

Like what you’re hearing? Get Started