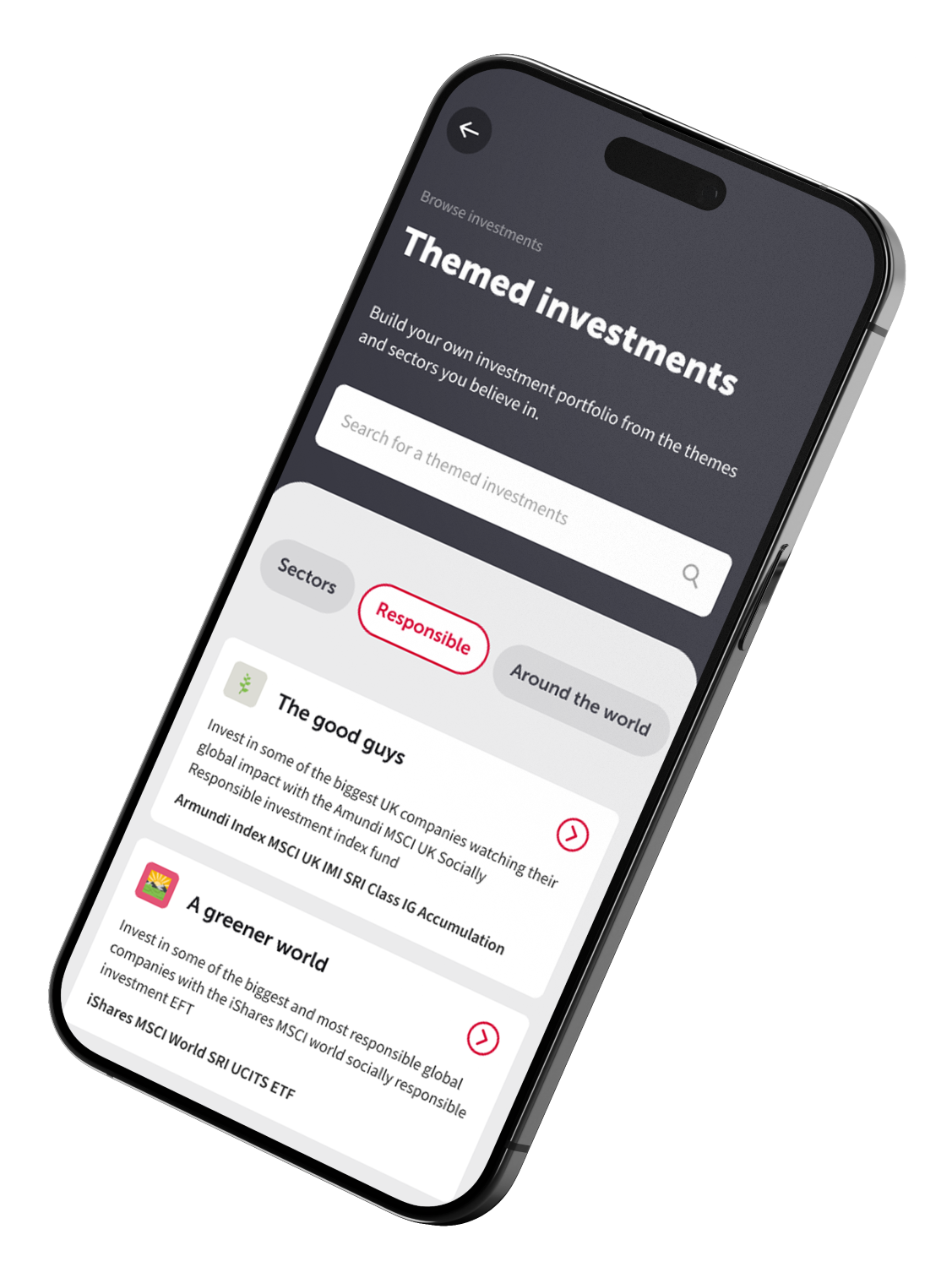

Thematic investments

Build an investment portfolio with the index funds and exchange traded funds which reflect your values. Invest in the themes you believe in, from specific sectors and regions through to responsible investments.

Browse our themed investments

Select a category to find more information about the themed investments available.

-

The home team 🏠

Invest in the UK's medium sized companies with the Vanguard FTSE 250 ETF

The home team 🏠

What's the fund?

Vanguard FTSE 250 ETF

What's to like about this fund?

This fund tracks the performance of those 250 listed companies just outside the biggest 100 in the UK: the FTSE 250. The best of the rest of British brands and companies, and you might recognise a few of them - like high street favourite M&S and Warhammer creator Games Workshop. Many of these companies are less global than their FTSE 100 counterparts, looking for long-term growth in the UK market.

Who looks after this fund?

Vanguard is one of the largest investment companies in the world, with a long history of managing funds.

What else do you need to know?

The experts at AJ Bell have chosen this fund for the Dodl investment range, but it’s not a personal recommendation or advice.

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember, investing carries risk – you could lose money as well as make it.

Across the pond 🗽

Invest in some of the biggest US companies with the SPDR S&P 500 ETF

Across the pond 🗽

What's the fund?

SPDR S&P 500 ETF

What's to like about this fund?

Tracks the most well-known index of the US stock market, the S&P 500, giving you the chance to invest in some of the most recognisable global brands - Apple and Amazon, anyone? This fund follows the performance of these big US companies, which span a broad range of sectors. If you're looking for a taste of America for your investment portfolio, keep this one in mind.

Who looks after this fund?

SPDR (pronounced Spider) are the ETF division of State Street Global Advisers, one of the largest investment companies in the world and creators of the US’ first and one of the world’s largest ETFs.

What else do you need to know?

The experts at AJ Bell have chosen this fund for the Dodl investment range, but it’s not a personal recommendation or advice.

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember, investing carries risk – you could lose money as well as make it.

On the continent 🥐

Invest in some of the biggest European (excl. UK 😬) companies with the Vanguard FTSE Developed Europe ex UK Index Fund

On the continent 🥐

What's the fund?

Vanguard FTSE Developed Europe ex-UK index fund

What's to like about this fund?

Follow some of the biggest European companies (excluding the UK ones) like Nestle and Roche. With this fund, you'll track the performance of hundreds of European-listed companies spread across a range of different sectors. Looking for another region to dip your investment toe in (diversify, diversify, diversify!)?

Who looks after this fund?

Vanguard is one of the largest investment companies in the world, with a long history of managing funds.

What else do you need to know?

The experts at AJ Bell have chosen this fund for the Dodl investment range, but it’s not a personal recommendation or advice.

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember, investing carries risk – you could lose money as well as make it.

Going east 🎌

Invest in some of the biggest Japanese companies with the Fidelity index Japan fund

Going east 🎌

What's the fund?

Fidelity index Japan fund

What's to like about this fund?

One of the biggest economies in the world, Japan is a serious global force with some seriously global brands to boot - think Toyota and Sony, to name a few. Investing exclusively in shares, this fund aims for long-term growth by bringing the biggest Japanese listed companies into your portfolio.

Who looks after this fund?

Fidelity, and you may well have heard of them as they’re one of the biggest fund manager names out there.

What else do you need to know?

The experts at AJ Bell have chosen this fund for the Dodl investment range, but it’s not a personal recommendation or advice.

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember, investing carries risk – you could lose money as well as make it.

Be more pacific 🥥

Invest in some of the biggest companies based in the Asia-Pacific region with the Vanguard Pacific ex-Japan index fund

Be more pacific 🥥

What's the fund?

Vanguard Pacific ex-Japan index fund

What's to like about this fund?

Follow some of the biggest listed companies in the Asia Pacific region. So you know, in the investment world this region includes Australia and New Zealand but not China or Japan. Though it covers just one region of the world, this fund includes companies with truly global reach, and invests across a wide range of sectors from finance to energy.

Who looks after this fund?

Vanguard is one of the largest investment companies in the world, with a long history of managing funds.

What else do you need to know?

The experts at AJ Bell have chosen this fund for the Dodl investment range, but it’s not a personal recommendation or advice.

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember, investing carries risk – you could lose money as well as make it.

The global climbers 🧗♀️

Invest in companies from across the world's developing economies with the iShares Core MSCI Emerging Markets ETF

The global climbers 🧗♀️

What's the fund?

iShares Core MSCI Emerging Markets ETF

What's to like about this fund?

This fund tracks the theme investor types call 'emerging markets'. It aims to capture the overall performance of large, medium and small companies, from the world's up & coming economies. Investing in emerging markets can bring higher risk but with the potential for higher rewards over the long term.

Who looks after this fund?

iShares by BlackRock - an international leader in providing funds which track a particular investment theme (like this one).

What else do you need to know?

The experts at AJ Bell have chosen this fund for the Dodl investment range, but it’s not a personal recommendation or advice.

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember, investing carries risk – you could lose money as well as make it.

On top of the world 🌏

Invest in some of the biggest companies from all corners of the globe with the HSBC FTSE All-World index fund

On top of the world 🌏

What's the fund?

HSBC FTSE All-World index fund

What's to like about this fund?

This fund takes you on an around the world trip of the biggest global companies. Track the performance of the brands which are truly international - from countries with both developed and growing investment markets.

Who looks after this fund?

HSBC – yes, worldwide bank and investment provider. They’re a FTSE 100 company too, show offs!

What else do you need to know?

The experts at AJ Bell have chosen this fund for the Dodl investment range, but it’s not a personal recommendation or advice.

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember, investing carries risk – you could lose money as well as make it.

Global Shariah ☪

Invest in a some of the biggest global companies via the Shariah approved iShares World Islamic ETF

Global Shariah ☪

What's the fund?

iShares MSCI World Islamic ETF

What's to like about this fund?

Invest in some of the biggest companies throughout the developed world via an exchange traded fund which follows Shariah-compliant investing principles. The manager of this fund filters out companies involved in activities such as conventional finance, alcohol and gambling while keeping a significant investment in sectors like tech and healthcare.

Who looks after this fund?

iShares by BlackRock - an international leader in providing funds which track a particular investment theme.

What else do you need to know?

The experts at AJ Bell have chosen this fund for the Dodl investment range, but it’s not a personal recommendation or advice.

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember, investing carries risk – you could lose money as well as make it.

Chinese titans 🐼

Invest in some of China's biggest companies with the HSBC China ETF

Chinese titans 🐼

What's the fund?

HSBC MSCI China ETF

What's to like about this fund?

Want to invest in China but not sure where to start? This exchange traded fund is one of the largest Chinese market trackers out there, letting you invest in many of the top Chinese companies all together, including globally recognised names like Tencent and Alibaba.

Who looks after this fund?

HSBC – yes, worldwide bank and investment provider. They’re a FTSE 100 company too, show offs!

What else do you need to know?

The experts at AJ Bell have chosen this fund for the Dodl investment range, but it’s not a personal recommendation or advice.

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember, investing carries risk – you could lose money as well as make it.

Bollywood bound 🐅

Invest in some of India's biggest companies with the Franklin FTSE India ETF

Bollywood bound 🐅

What's the fund?

Franklin FTSE India ETF

What's to like about this fund?

This fund is designed to provide investors with exposure to the Indian market by investing in a broad range of companies listed in India.

Who looks after this fund?

Franklin Templeton, a global leader in asset management with more than 7 decades of experience.

What else do you need to know?

The experts at AJ Bell have chosen this fund for the Dodl investment range, but it’s not a personal recommendation or advice.

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember, investing carries risk – you could lose money as well as make it.

UK top 💯

Invest in the UK’s biggest companies with the Vanguard FTSE 100 index unit trust

UK top 100

What's the fund?

Vanguard FTSE 100 index unit trust

What's to like about this fund?

This fund invests in the 100 largest companies listed here in the UK - the 'FTSE 100'. From AstraZeneca to Unliever, you'll be able to track the overall performance of these big British names by adding this single fund to your investment portfolio.

Who looks after this fund?

Vanguard is one of the largest investment companies in the world, with a long history of managing funds.

What else do you need to know?

The experts at AJ Bell have chosen this fund for the Dodl investment range, but it’s not a personal recommendation or advice.

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember, investing carries risk – you could lose money as well as make it.

The property tycoon 🏦

Invest in the biggest property companies from around the world with the Legal & General Global Real Estate Dividend index fund

The property tycoon 🏦

What's the fund?

Legal & General Global Real Estate Dividend index fund

What's to like about this fund?

Grab your piece of the global real-estate pie by investing in a fund which tracks property companies, both big and small, spanning a wide range of industries and countries.

Who looks after this fund?

Legal & General have been looking after index funds, like this one, for over 25 years.

What else do you need to know?

The experts at AJ Bell have chosen this fund for the Dodl investment range, but it’s not a personal recommendation or advice.

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember, investing carries risk – you could lose money as well as make it.

Made of money 💸

Invest in the biggest finance companies across the globe with the Xtrackers World Financials ETF

Made of money 💸

What's the fund?

Xtrackers MSCI World Financials ETF

What's to like about this fund?

If you want a dash of the finance sector adding to your investment portfolio, it may be worth considering this exchange traded fund. The manager of this fund follows the money, quite literally. Tracking the performance of the world's largest finance firms, ranging from insurance companies like Berkshire Hathaway to payment services like Mastercard.

Who looks after this fund?

Xtrackers, by German investment management group DWS, is one of the world's largest providers of exchange traded funds and exchange traded commodities.

What else do you need to know?

The experts at AJ Bell have chosen this fund for the Dodl investment range, but it’s not a personal recommendation or advice.

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember, investing carries risk – you could lose money as well as make it.

The powerhouse 🔋

Invest in the biggest global energy companies with the iShares S&P 500 Energy Sector ETF

The powerhouse 🔋

What's the fund?

iShares S&P 500 Energy Sector ETF

What's to like about this fund?

You could add a surge of power to your portfolio with this exchange traded fund. It not only tracks the performance of familiar UK-based energy companies like BP and Shell but providers from all over the developed world, such as ExxonMobil and TotalEnergies.

Who looks after this fund?

iShares by BlackRock - an international leader in providing funds which track a particular investment theme.

What else do you need to know?

The experts at AJ Bell have chosen this fund for the Dodl investment range, but it’s not a personal recommendation or advice.

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember, investing carries risk – you could lose money as well as make it.

Going for gold 🥇

Invest in the gold market with the iShares Physical Gold ETC

Going for gold 🥇

What's the fund?

iShares Physical Gold ETC

What's to like about this fund?

ETC stands for exchange traded commodity, and the commodity here is pure, solid gold. Though you won't get your hands on a bar of bullion (sorry!), you do get an investment which tracks the day-to-day movements of the physical gold market - a market which can be a stabilising addition to any portfolio.

Who looks after this fund?

iShares by BlackRock - an international leader in providing funds which track a particular investment theme.

What else do you need to know?

The experts at AJ Bell have chosen this fund for the Dodl investment range, but it’s not a personal recommendation or advice.

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember, investing carries risk – you could lose money as well as make it.

Robo revolution🤖

Invest in the biggest robotics companies from around the world with the iShares Automation and Robotics ETF

Robo revolution🤖

What's the fund?

iShares Automation & Robotics ETF

What's to like about this fund?

Society is adopting more and more automated processes, using robotics and AI to bring innovative solutions to our everyday problems. You can be part of these solutions by investing in the companies driving the global trend towards automation. This fund aims to track the world's biggest and best robotics and automation companies to provide investors with long-term growth.

Who looks after this fund?

iShares by BlackRock - an international leader in providing funds which track a particular investment theme.

What else do you need to know?

The experts at AJ Bell have chosen this fund for the Dodl investment range, but it’s not a personal recommendation or advice.

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember, investing carries risk – you could lose money as well as make it.

The building blocks 🚆

Invest in the biggest infrastructure companies from around the world with the Legal & General Global Infrastructure index fund

The building blocks 🚆

What's the fund?

Legal & General Global Infrastructure index fund

What's to like about this fund?

This fund tracks the biggest companies from around the world which provide our fundamental physical systems - transportation, energy and, yes, even sewage companies. They're not particularly sexy, but these ‘infrastructure’ companies are the building blocks of 21st century living.

Who looks after this fund?

Legal & General have been looking after index funds, like this one, for over 25 years.

What else do you need to know?

The experts at AJ Bell have chosen this fund for the Dodl investment range, but it’s not a personal recommendation or advice.

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember, investing carries risk – you could lose money as well as make it.

Full health 🩺

Invest in the biggest healthcare companies in the developed world with the Xtrackers MSCI World Healthcare ETF

Full health 🩺

What's the fund?

Xtrackers MSCI World Healthcare ETF

What's to like about this fund?

This fund tracks the performance of some of the world's biggest healthcare, pharmaceutical and biotech companies, like Pfizer and Johnson & Johnson. Investing in it gives your portfolio a dose of the global healthcare sector.

Who looks after this fund?

Xtrackers, by German investment management group DWS, is one of the world's largest providers of exchange traded funds and exchange traded commodities.

What else do you need to know?

The experts at AJ Bell have chosen this fund for the Dodl investment range, but it’s not a personal recommendation or advice.

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember, investing carries risk – you could lose money as well as make it.

Big tech 💻

Invest in the biggest tech companies in the developed world with the Legal & General Global Technology index trust

Big tech 💻

What's the fund?

Legal & General Global Technology index trust

What's to like about this fund?

Invest in the companies pioneering some of the world's greatest technological advancements. This fund tracks the performance of companies who are at the cutting-edge of information technology progress, globally, like Apple, Microsoft and Google.

Who looks after this fund?

Legal & General have been looking after index funds, like this one, for over 25 years.

What else do you need to know?

The experts at AJ Bell have chosen this fund for the Dodl investment range, but it’s not a personal recommendation or advice.

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember, investing carries risk – you could lose money as well as make it.

The government's IOU 💷

Invest in the UK by lending the government money with the iShares Core UK Gilt ETF

The government's IOU 💷

What's the fund?

iShares Core UK Gilt ETF

What's to like about this fund?

The Treasury (the government department which holds the national piggy bank) raise money through special loans called 'gilts' which pay interest, to make it worth the lender's while. This fund pools together lots of investors’ money to buy some of these gilts - aiming to grow the fund with the interest they pay. Though gilts are usually less risky than shares, the potential for higher returns is limited.

Who looks after this fund?

iShares by BlackRock - an international leader in providing funds which track a particular investment theme (like this one).

What else do you need to know?

The experts at AJ Bell have chosen this fund for the Dodl investment range, but it’s not a personal recommendation or advice.

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember, investing carries risk – you could lose money as well as make it.

Hey big lender 💰

Lend to companies from around the world when you invest in the Vanguard Global Corporate Bond index fund

Hey big lender 💰

What's the fund?

Vanguard Global Corporate Bond index fund

What's to like about this fund?

You can invest in companies from all around the world by lending them money - this type of loan is called a 'corporate bond'. Companies often raise money this way to help drive their growth while paying interest to investors in return. With this fund you'll be investing in corporate bonds from all around the world - hey big lender!

Who looks after this fund?

Vanguard is one of the largest investment companies in the world, with a long history of managing funds.

What else do you need to know?

The experts at AJ Bell have chosen this fund for the Dodl investment range, but it’s not a personal recommendation or advice.

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember, investing carries risk – you could lose money as well as make it.

The worldwide debt 🌎

Lend to global governments when you invest in the HSBC Global Government Bond ETF

The worldwide debt 🌎

What's the fund?

HSBC Global Government Bond ETF

What's to like about this fund?

This fund lends to governments all around the world so you'd be investing in global govt. debt (debt can be an investment - who knew?!). This may not seem the most appealing of options but it can be a good way to balance a share-heavy portfolio and keep your risk of loss down, since governments are less likely to default on their debts.

Who looks after this fund?

HSBC – yes, worldwide bank and investment provider. They’re a FTSE 100 company too, show offs!

What else do you need to know?

The experts at AJ Bell have chosen this fund for the Dodl investment range, but it’s not a personal recommendation or advice.

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember, investing carries risk – you could lose money as well as make it.

Lending the way 💼

Invest in global debt offering potentially higher returns with the State Street Global High Yield Bond index fund

Lending the way 💼

What's the fund?

State Street Global High Yield Bond index fund

What's to like about this fund?

Invests in companies, from both the developed and emerging markets of the world, which are riskier prospects in terms of paying back their debts - but with higher risk comes potentially higher returns. Global high yield bonds, like those this fund invests in, have the usual characteristics of bonds, but their performance is often more responsive to company earnings and economic developments, like shares, rather than interest rates.

Who looks after this fund?

State Street Corporation is one of the world’s largest investment managers and a pioneer in ETF and index investing.

What else do you need to know?

The experts at AJ Bell have chosen this fund for the Dodl investment range, but it’s not a personal recommendation or advice.

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember, investing carries risk – you could lose money as well as make it.

Lifestrategy (40% shares)

Invest in a medium-risk mix of investments from a range of sectors and regions with the Vanguard LifeStrategy 40% shares fund

All-in-one (40% shares)

What's the fund?

Vanguard LifeStrategy 40% Equity fund

What's to like about this fund?

Finance types call this a 'multi-asset' fund because it invests in thousands of shares and bonds from all over the world and from a wide range of sectors. With 40% of the fund going to shares and the rest to bonds, if you're looking for potential returns whilst keeping the ups and downs to a minimum, take a closer look.

Who looks after this fund?

Vanguard is one of the largest investment companies in the world, with a long history of managing funds.

What else do you need to know?

The experts at AJ Bell have chosen this fund for the Dodl investment range, but it’s not a personal recommendation or advice.

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember, investing carries risk – you could lose money as well as make it.

Lifestrategy (60% shares)

Invest in a medium-risk mix of investments from a range of sectors and regions with the Vanguard LifeStrategy 60% shares fund

All-in-one (60% shares)

What's the fund?

Vanguard LifeStrategy 60% Equity fund

What's to like about this fund?

Finance types call this a 'multi-asset' fund because it invests in thousands of shares and bonds from all over the world and from a wide range of sectors. With 60% of the fund going to shares and the rest to bonds, it's an all-rounder option which balances risk with reward.

Who looks after this fund?

Vanguard is one of the largest investment companies in the world, with a long history of managing funds.

What else do you need to know?

The experts at AJ Bell have chosen this fund for the Dodl investment range, but it’s not a personal recommendation or advice.

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember, investing carries risk – you could lose money as well as make it.

Lifestrategy (80% shares)

Invest in a higher-risk mix of investments from a range of sectors and regions with the Vanguard LifeStrategy 80% shares fund

All-in-one (80% shares)

What's the fund?

Vanguard LifeStrategy 80% Equity fund

What's to like about this fund?

Investor types call this a 'multi-asset' fund because it invests in thousands of shares and bonds from all over the world and from a wide range of sectors. With 80% of the fund allocated to shares and the rest to bonds, it tips the balance towards shares meaning greater risk - more ups and downs - but potentially greater rewards over the long term.

Who looks after this fund?

Vanguard is one of the largest investment companies in the world, with a long history of managing funds.

What else do you need to know?

The experts at AJ Bell have chosen this fund for the Dodl investment range, but it’s not a personal recommendation or advice.

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember, investing carries risk – you could lose money as well as make it.

Socially responsible Global 🧩

Invest in some of the largest global companies, with best-in-class ESG credentials (as per the MSCI ESG Ratings), with iShares MSCI World Socially Responsible Investment ETF.

Socially responsible Global 🧩

What's the fund?

iShares MSCI World Socially Responsible Investment ETF

What's to like about this fund?

The fund invests in some of the world’s largest companies that display best in class ESG credentials, by only selecting those companies that have the highest MSCI ESG Ratings. The fund also includes exclusionary filters for companies that are involved in; Nuclear power, Nuclear Weapons, Tobacco, Alcohol, Gambling, Controversial Weapons, Conventional Weapons, Civilian Firearms, Genetically modified organisms (GMO) and Adult Entertainment. Additionally, the fund has enhanced environmental credentials with further checks undertaken on companies involved in Thermal Coal, Oil Sands, Oil & Gas, Power Generation and Thermal Coal/Oil Sands Reserves industries.

Who looks after this fund?

iShares by BlackRock - an international leader in providing funds which track a particular investment theme.

What else do you need to know?

The experts at AJ Bell have chosen this fund for the Dodl investment range, but it’s not a personal recommendation or advice.

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember, investing carries risk – you could lose money as well as make it.

Socially responsible UK 🪁

Invest in large, mid and small-cap companies of the UK market, with best-in-class ESG credentials (as per the MSCI ESG Ratings), with the Amundi MSCI UK Socially Responsible Investment index fund.

Socially responsible UK 🪁

What's the fund?

Amundi MSCI UK Socially Responsible Investment index fund

What's to like about this fund?

The fund invests in UK companies that display best in class ESG credentials, by only selecting those companies that have the highest MSCI ESG Ratings. The fund also includes exclusionary filters for companies that are involved in; Nuclear power, Nuclear Weapons, Tobacco, Alcohol, Gambling, Controversial Weapons, Conventional Weapons, Civilian Firearms, Oil & Gas, Thermal Coal, Fossil Fuel Reserves, Genetically modified organisms (GMO) and Adult Entertainment. Additionally, the fund meets the EU Paris-aligned benchmark (EU PAB) regulation minimum requirements on climate transition.

Who looks after this fund?

Amundi – you may not have heard of them but they’re one of the ten biggest investment managers in the world.

What else do you need to know?

The experts at AJ Bell have chosen this fund for the Dodl investment range, but it’s not a personal recommendation or advice.

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember, investing carries risk – you could lose money as well as make it.

Cash market fund 💰

Invest in cash-like investments, for those looking for a lower risk option before investing elsewhere or withdrawing your money.

Cash market fund 💰

What's the fund?

Blackrock ICS Sterling Liquidity Premier MMF

What's to like about this fund?

This is a cash investment, which is a low–risk investment that aims to protect your money and pay you some interest. The fund invests in cash deposits, cash-like instruments and short-term loans to governments & companies. This fund can be used to hold cash for the short term if you want some time to decide where else to invest or you might withdraw your money soon.

Who looks after this fund?

Blackrock - an international leader in providing funds which track a particular investment theme.

What else do you need to know?

The experts at AJ Bell have chosen this fund for the Dodl investment range, but it’s not a personal recommendation or advice.

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember, investing carries risk – you could lose money as well as make it.

Remember investing carries risk – investments can fall and rise in value and you could get back less than you put in. Make sure you read all the investment details in the app and understand its charges before you place your order.

How do you invest in the themes?

You can do it in 3 simple steps.

-

Open your Dodl account

Sign up, choose investment account then open it - all in a matter of minutes

-

Add cash

Begin by adding as little as £100, or set up a monthly direct debit from £25

-

Start investing

Choose your theme(s), read up on the details then start building your portfolio!

Help’s on hand

Head to the help centre to have all your questions answered. And you can chat to Team Dodl anytime in the app or at hello@dodl.co.uk.

You can always learn more before (and after) taking your first investing steps with Dodl. Pop the kettle on, get comfortable and head to the Dodl blog, where you can master the basics of investing.

It's important to know

You have to be a UK resident for tax purposes to open an account with Dodl.

Investing is an opportunity to grow your money, typically outperforming cash savings over the long term. However, investing comes with risk as well as reward, and the value of your investments can go down as well as up. Tax benefits depend on your circumstances and tax rules may change. Any information we provide is to help with your research and isn't financial advice.

Dodl doesn’t offer any advice so if you’re not sure about the risks involved with investing, you should speak to a qualified financial adviser.