Investing in funds

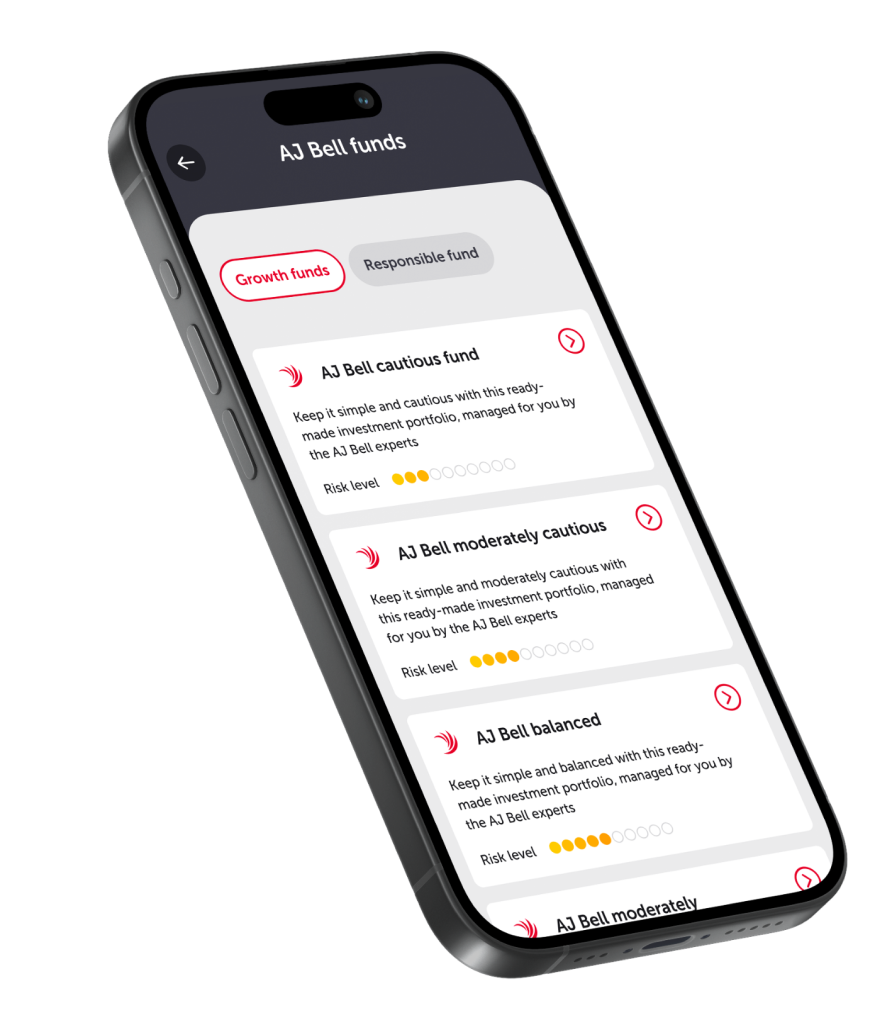

Get to know the seven ready-made investment portfolios available with Dodl, each built and managed by the AJ Bell experts - leaving you to get on with more important things!

Browse the funds

Discover the range of growth funds or check out something more responsible.

-

Cautious

Keep it simple and cautious with this ready-made investment portfolio, managed for you by the AJ Bell experts

Risk level:

AJ Bell cautious

What's to like about this fund?

A ready-to-go mix of investments, wrapped up in one cautious bundle. Being the cautious type, this fund aims to bring you a steadier return over the long term, whilst minimising the ups and downs along the way. Because the risk is lower the returns are likely to be too.

Who looks after this fund?

AJ Bell Investments – definitely not biased, but they’re a top bunch who keep your goals at the heart of everything they do.

What else do you need to know?

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember that investing carries risk – you could lose money as well as make it.

Moderately cautious

Keep it simple and moderately cautious with this ready-made investment portfolio, managed for you by the AJ Bell experts

Risk level:

AJ Bell moderately cautious

What's to like about this fund?

Feeling somewhere between cautious and balanced on the investometer? Time to introduce you to the moderately cautious fund. Catchy, isn’t it!? But it is exactly that. This ready-made bundle of investments is built for growth over the long term whilst protecting you from too many ups and downs along the way.

Who looks after this fund?

AJ Bell Investments – definitely not biased, but they’re a top bunch who keep your goals at the heart of everything they do.

What else do you need to know?

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember that investing carries risk – you could lose money as well as make it.

Balanced

Keep it simple and balanced with this ready-made investment portfolio, managed for you by the AJ Bell experts

Risk level: 5

AJ Bell balanced

What's to like about this fund?

If you’re after a balanced-diet approach to investing with a bit of everything, here’s a portfolio of investments which is just that. Built and managed by the experts to match risk for reward, the balanced fund aims for solid long-term growth whilst keeping the bigger bumps at bay.

Who looks after this fund?

AJ Bell Investments – definitely not biased, but they’re a top bunch who keep your goals at the heart of everything they do.

What else do you need to know?

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember that investing carries risk – you could lose money as well as make it.

Moderately adventurous

Keep it simple and moderately adventurous with this ready-made investment portfolio, managed for you by the AJ Bell experts

Risk level: 6

AJ Bell moderately adventurous

What's to like about this fund?

Maybe you’re feeling a bit adventurous, 'moderately adventurous' if you will. The experts invest most of this fund in shares, for those potentially higher long-term rewards, but keep a small portion in more secure investments, like bonds and cash - just to rein it in a bit.

Who looks after this fund?

AJ Bell Investments – definitely not biased, but they’re a top bunch who keep your goals at the heart of everything they do.

What else do you need to know?

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember that investing carries risk – you could lose money as well as make it.

Adventurous

Keep it simple and adventurous with this ready-made investment portfolio, managed for you by the AJ Bell experts

Risk level: 7

AJ Bell adventurous

What's to like about this fund?

Designed with adventure in mind, this portfolio is predominately share-based and so falls on the riskier side of things. But with greater risk comes the potential for greater rewards over the long term. You’ll need to feel comfortable with the sharper ups and downs though.

Who looks after this fund?

AJ Bell Investments – definitely not biased, but they’re a top bunch who keep your goals at the heart of everything they do.

What else do you need to know?

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember that investing carries risk – you could lose money as well as make it.

Global growth

Keep it simple and focused on global growth with this ready-made investment portfolio, managed for you by the AJ Bell experts

Risk level: 8

AJ Bell global growth

What's to like about this fund?

The most adventurous of all the AJ Bell funds, global growth seeks out the companies from around the world which have the greatest potential to grow and bring you higher returns over the long term. But you may be in for a bit of a bumpy ride, with many of this fund's investments carried along with market ups and downs.

Who looks after this fund?

AJ Bell Investments – definitely not biased, but they’re a top bunch who keep your goals at the heart of everything they do.

What else do you need to know?

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember that investing carries risk – you could lose money as well as make it.

Responsible screened growth

Keep it simple and responsible with this ready-made investment portfolio, managed for you by the AJ Bell experts

Risk level: 7

AJ Bell responsible screened growth

What's to like about this fund?

Now for something a little different. A ready-made portfolio with a responsible finish. The responsible growth fund looks for higher long-term returns so takes a higher level of risk, like the adventurous fund. But is made up of companies taking their commitment to people and planet seriously. Ultimately, it aims to do good for your future and everyone else's.

Who looks after this fund?

AJ Bell Investments – definitely not biased, but they’re a top bunch who keep your goals at the heart of everything they do.

What else do you need to know?

Always carry out your own research when choosing your investments and make sure you read and understand the fund's key investor information and charges. If you’re ever unsure about choosing your own investments, it's best to speak to an independent financial adviser about this.

And remember that investing carries risk – you could lose money as well as make it.

Pension builder fund

Dodl’s standard, low-cost pension investment option, built and balanced by the AJ Bell experts.

Risk level: 5

Pension builder fund

What's to like about this fund?

The pension builder fund is your simple, ready-made investment option, that helps you get off the mark investing in your Dodl pension. Behind the name is AJ Bell's balanced fund - learn more about it in the key details.

Could the builder fund be for you?

✓ You're after a ready-made 'hands-off' pension investment, managed for you by the AJ Bell experts

✓ You're aiming for steady pension growth without taking too much risk

✓ You're just starting out investing and/or not quite ready to build your own investment portfolio

✓ You're looking to invest for the long-term

Who looks after this fund?

AJ Bell Investments – definitely not biased, but they’re a top bunch who keep your goals at the heart of everything they do.

What else do you need to know?

The pension builder fund can help you invest for retirement, but it isn't tailored to you or your circumstances. That means it isn’t built for your specific needs, goals, or stage of life and isn’t a personal recommendation. Why is the pension builder fund offered?

Not sure whether it's the right investment to make? Speaking to a financial adviser can help you decide.

Always remember, the value of investments can change and you could lose money as well as make it.

Remember investing carries risk – investments can fall and rise in value and you could get back less than you put in. Make sure you read all the investment details in the app and understand its charges and the risks before you place your order.

How do you invest in the AJ Bell funds?

You can do it in 3 simple steps once you've downloaded the app.

-

Open a Dodl account

Sign up, choose an investment account and open it - all in a matter of minutes

-

Add cash

Begin by adding as little as £100, or set up a monthly direct debit from £25

-

Start investing

Choose the AJ Bell fund you want, read all its key details, then place your order to invest!

Help’s on hand

Head to the help centre to have all your questions answered. And you can chat to Team Dodl anytime in the app or at hello@dodl.co.uk.

You can always learn more before (and after) taking your first investing steps with Dodl. Pop the kettle on, get comfortable and head to the Dodl blog, where you can master the basics of investing.

It's important to know

You have to be a UK resident for tax purposes to open an account with Dodl.

Investing is an opportunity to grow your money, typically outperforming cash savings over the long term. However, investing comes with risk as well as reward, and the value of your investments can go down as well as up. Tax benefits depend on your circumstances and tax rules may change. Any information we provide is to help with your research and isn't financial advice.

Dodl doesn’t offer any advice so if you’re not sure about the risks involved with investing, you should speak to a qualified financial adviser.