Why invest with Dodl?

Whether you're looking to take your first investing steps or just know a good deal when you see one, Dodl is the easy choice.

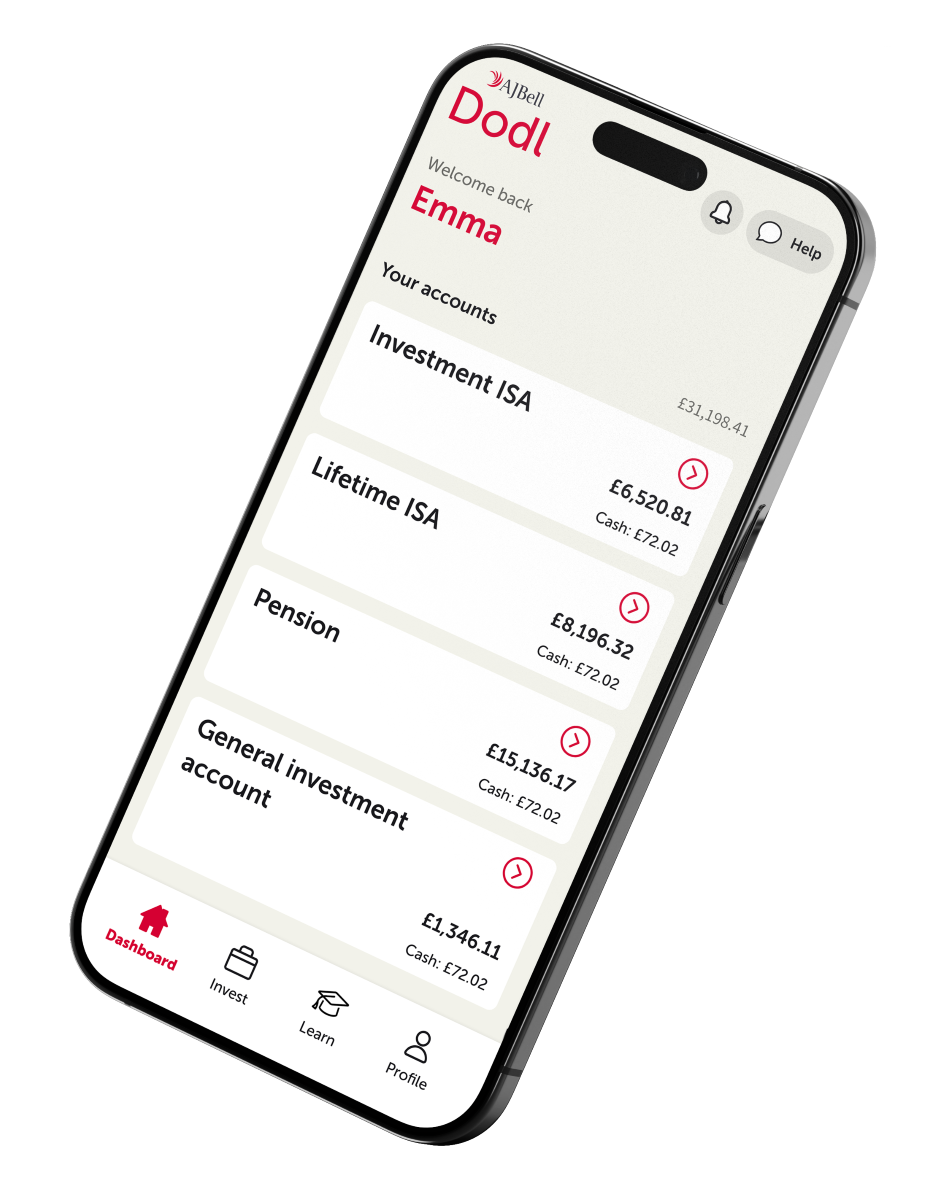

The accounts

What financial goal are you aiming for? Chances are there's a Dodl investment account that can help you reach it. Opening, or transferring, an account is your first step towards investing in your future.

If you're looking to invest for a child, with a partner or for a business, Dodl can't help you here. But AJ Bell can! Explore the wider range of AJ Bell accounts.

The charges

Compare your Dodl account to other providers and see how much you could save.

| Investment ISA with... |

Monthly subscription? |

Annual % charge? |

Interest rate on cash |

How it works out for a £10,000 investment ISA (monthly/annually)? |

|---|---|---|---|---|

| Dodl | Nope | 0.15% (min £1 per month) |

4.06% AER variable* | £1.25 / £15 |

| Freetrade | £5.99 | Nope | 3.00% AER variable | £5.99 / £71.88 |

| Moneybox | £1 | 0.45% | 4.45% AER variable | £4.75 / £57 |

| Nutmeg | Nope | 0.45% - 0.75% | 2.50% AER variable | £5.50 / £66 |

| Vanguard | Nope | 0.15% (min £4 per month) | 1.95% AER variable | £4 / £48 |

1. Charges, subscriptions and interest rates based on those published on all providers' websites on 24 October 2025. Charges can and do change so it's best to check websites for the latest figures. 2. Example of annual and monthly charges based on an investment ISA portfolio value of £10,000. 3. Investment charges, e.g. FX charges for shares and ongoing charges for funds aren't included in this table. 4. Freetrade's charge is based on their standard plan, paid monthly. 5. Vanguard's charge is per person rather than per account. And for the purposes of this comparison table, an average of Nutmeg's annual charge has been used (0.60%). 6. Because charges (with the exception of Freetrade) are based on the value of your investments, monthly charges will change as investment values change.

* Interest rate is 3.80% AER from 1 February 2026.

It's good to know

Dodl is brought to you by AJ Bell, a FTSE 250 investment platform that's been making investing accessible to all for over 30 years. It's also one of the very best things about Dodl - you get all the experience of an established, trusted name packaged up in a slick, easy-to-use investment app.

Here are more reasons to be confident when you invest with Dodl.