Crazy little thing called investing ❣

A slightly different take on Valentine's Day spending...

In the realm of love, we often talk about the priceless moments, the heartwarming gestures, and the connections that make life truly special. But have you ever wondered about the potential financial returns if you invested your Valentine's Day spending? 🤑

Probably not... but at Dodl, we couldn't resist the temptation to explore the hidden investment gain within the heart-shaped confines of your annual love budget. So, let’s find out what happens when Cupid's arrow also strikes your investment portfolio… 🏹

The sweet spots: where the money goes 💸

We took a survey of 1,061 UK adults, who kindly spilled the beans on the most popular Valentine's gifts:

-

Confectionery (54%) 🍬

-

Fragrances (46%) 💨

-

Clothing (41%) 👗

-

Food/drink (33%) 🍔

-

Collectables (30%) 🔮

These gifts embody the spirit of Valentine's Day, but what if there was a way to transform these heartfelt gestures into lasting financial returns?

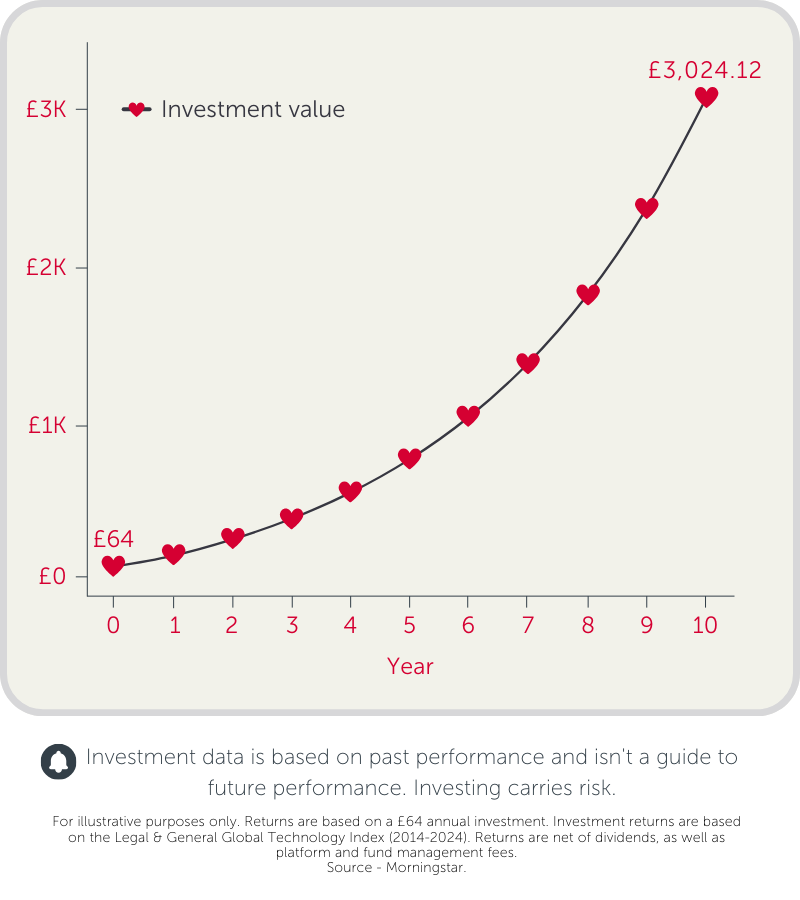

Our survey-takers also revealed that the average UK adult’s Valentine’s Day spending was a whopping £64! So, our team crunched the numbers, and we found that if this amount was invested annually in a Dodl fund, such as ‘Big tech 💻’, that investment could have cultivated a staggering £3,024 over a 10-year period.

Check out the graph below to see where your £64 a year could take you. It turns out that love isn't the only thing that grows with time, investments can too! 📈

A romantic gesture for your portfolio 😍

While treating your partner to gifts is heartwarming, envision the potential financial bouquet you could harvest by investing the same amount. With inflation and the cost of living on all our backs, maybe this Valentine’s Day, you could treat your partner to a nice ISA top-up, and give the gift of investing. 😎

Our analysis isn't here to diminish the joy of expressing love, but rather highlights the potential of turning those heartwarming moments into smart financial moves.

While completely boycotting Valentine’s giving may not seem like the most romantic thing to do, after a few years of investing that money, you might be able to treat your partner to something a lot more exciting than that naff box of chocolates you picked up from the petrol station…

So, why not let your love blossom in both your heart and your portfolio? 🌼

Love truly knows no bounds, especially when it comes to your financial success! 💕📈

🔔 Always remember, the value of your investments can go down as well as up. Dodl doesn’t give advice, so if you’re unsure about investing, it’s always best to speak to a financial adviser.