Pension guide

Get to grips with the pension essentials, from the basics to the nitty gritty 🔍

Pensions and the job market have seen some big changes lately. You may be aware of the traditional pension that was offered by your employer and paid after 40 years of service. Yeah, that’s not really a thing for most of us anymore. 🙉

Lots of people are taking control and opening up their own self-invested personal pensions, like the Dodl pension. With these, you get to pick and manage your investments all on your own. You can even have one of these alongside any other pensions you've got going on. And guess what? It opens up a whole new world of investment options that you might not get with other plans. 😄

With a self-invested personal pension, you get some lovely tax breaks. You'll get relief on the money you put into it, which basically means you get back the income tax you've paid. Although, when you start taking money out later on, you'll need to pay income tax on that, but hey, that's life, right?

Opening a pension like this online is a piece of cake these days. Plus, these platforms are usually pretty budget-friendly, so you can save more of those pennies to help you hopefully retire like a boss! 💪

Now, with ready-made investments like our AJ Bell funds, you don't have to be a finance guru to manage your pension. You can still have all the freedom to choose how you invest, when you retire, and how much cash you want to roll in with. But remember, with great freedom comes great responsibility, so it's important to think about how your decisions now will affect your golden years later. 🤔

Types of pensions

Personal pension - you set up your own pension plan through an insurance company or another company that handles pensions. It's like having your own little retirement fund. The cool thing about personal pensions? You get to call the shots on how your money is invested. Some employers might chip in, but it's not guaranteed.

Stakeholder pension - These pensions are like the people's champ of retirement savings! They're made to be super affordable and available to pretty much anyone – whether you're a freelancer, a part-timer, or just starting out in your career.

Occupational pension - A plan set up by your employer to help you save for the future. Plus, they often throw in some money alongside your own contributions.

Is a Dodl pension right for me?

If you want to save tax-efficiently for your retirement and are looking to increase the range of assets you can hold in your pension portfolio, then a Dodl pension could be ideal for you. 😎

Here are a few things to keep in mind 🧠:

- Like other pensions, one of the key advantages of a self-invested pension is that you get a lovely 20% tax relief on your contributions, up to the amount you earn. Plus, if you're a higher or additional rate taxpayer, you can reclaim the extra tax you've paid. Just remember, while you can enjoy a tax-free lump sum of up to 25%, any money you take out in retirement is subject to income tax. 💲

- Got a bunch of pensions from different jobs? No worries! You can consolidate them into a self-invested pension for easier management. Just be sure to check if you're giving up any guarantees from your current schemes before making the switch. 🔁

- If you've already got a decent-sized pension pot built up over the years, you might not need to contribute more. Lucky you! 🍀

- Want to pump more money into your pension? No problem! Saving into this kind of pension is super easy, whether you're doing it solo or with a little help from your employer. 💼

- Not into making investment decisions yourself or planning to make only small contributions? Your employer's pension or a stakeholder pension might be a better fit. 👖

- Remember, once your money's in a pension, it's like being on a train that you can't hop off until you're at least 55 (and that'll be 57 starting from 2028). So, be sure not to tie up more cash than you can comfortably afford. 🚆

Tax perks of a self-invested pension

Under the current tax rules, if you're working, you can put in up to 100% of your relevant UK earnings (whether from employment or self-employment) into your pension pot each year and get some lovely tax relief. 💰

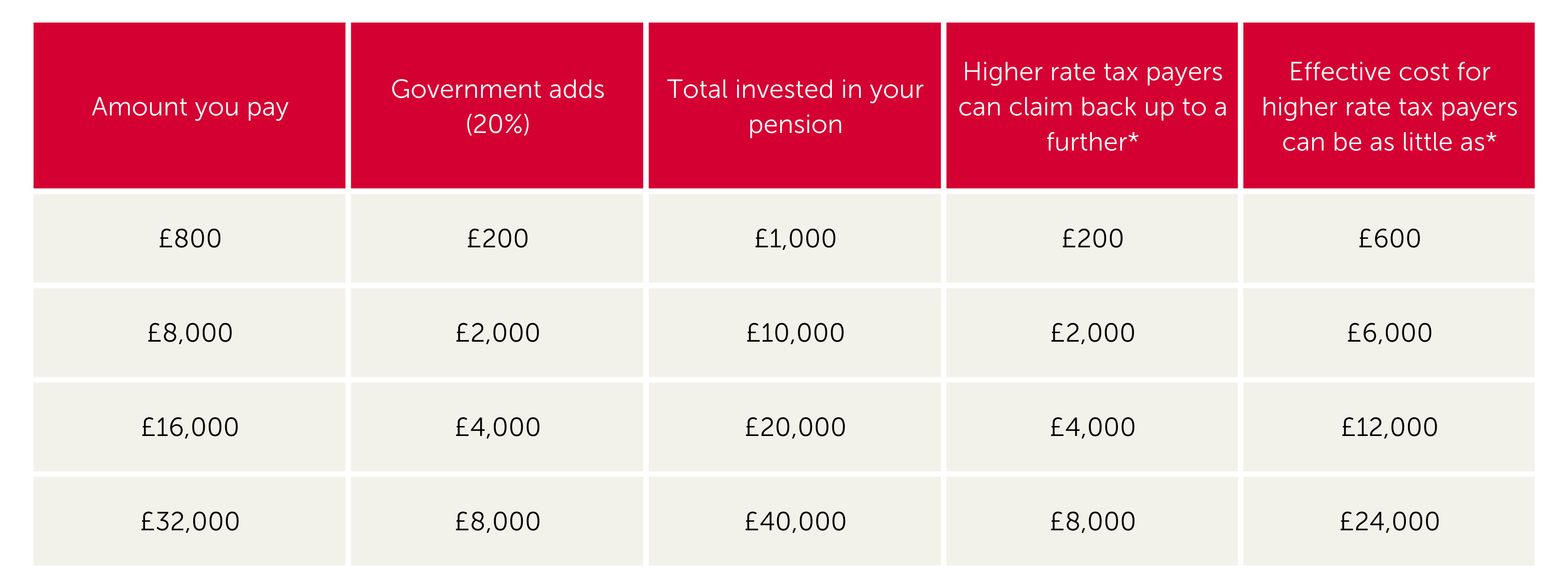

Here's how it works: Let's say you contribute £48,000 into your pension. With basic rate tax relief, your pension provider will automatically add £12,000 in tax relief to make it a total of £60,000. Essentially, for every 80p you put in, the government chips in 20p to make it £1.

Now, if you're a higher rate taxpayer, you can reclaim up to an additional 20% through your self-assessment tax return. That means if you contribute 80p, your SIPP provider will still add 20p, and you can reclaim up to another 20p later. So effectively, you can save £1 into your pension for as little as 60p. 👛

Just remember, though, that when you eventually withdraw money from your pension, you'll need to pay income tax on those withdrawals, except for the tax-free lump sum of up to 25%, but more on this later. For now, here’s a table to help you get your head around this tax relief malarkey.

*To reclaim the full amounts mentioned and get those effective costs down, the tax paid on the whole contribution amount must fall in the higher rate tax band. So, if you earn £80,000, you can contribute £16,000 net, and the whole £20,000 gross amount will have been taxed at the higher rate. That means you can reclaim the full additional £4,000. However, if you earn £60,000, only a small part of your earnings will have been taxed at the higher rate, so the amount you can claim back will be smaller.

For the 2023/24 tax year, if you're bringing in more than a whopping £260,000 annually (with a 'threshold income' exceeding £200,000), your annual pension allowance gets tapered down. Basically, for every extra £2 of income over £260,000, your allowance reduces by £1. The max reduction will be £50,000, so if you're making over £360,000, your allowance drops to £10,000. 📉

There's still some good news! Regardless of your income, if you're a UK resident under 75, you can stash away at least £3,600 into your SIPP each year. Whether you're working or not, you're entitled to this perk. And guess what? If you contribute £2,880, you'll get a lovely tax relief of 20%, bumping your total contribution up to £3,600.

But, and there’s always a but, if you go over your annual contribution allowance, HMRC will hit you with an annual allowance charge. They'll basically claw back the tax relief you received on the excess amount. So, keep an eye on those contributions and make sure you're within the limit. ⚖

Why you should be a pension early bird 🐦

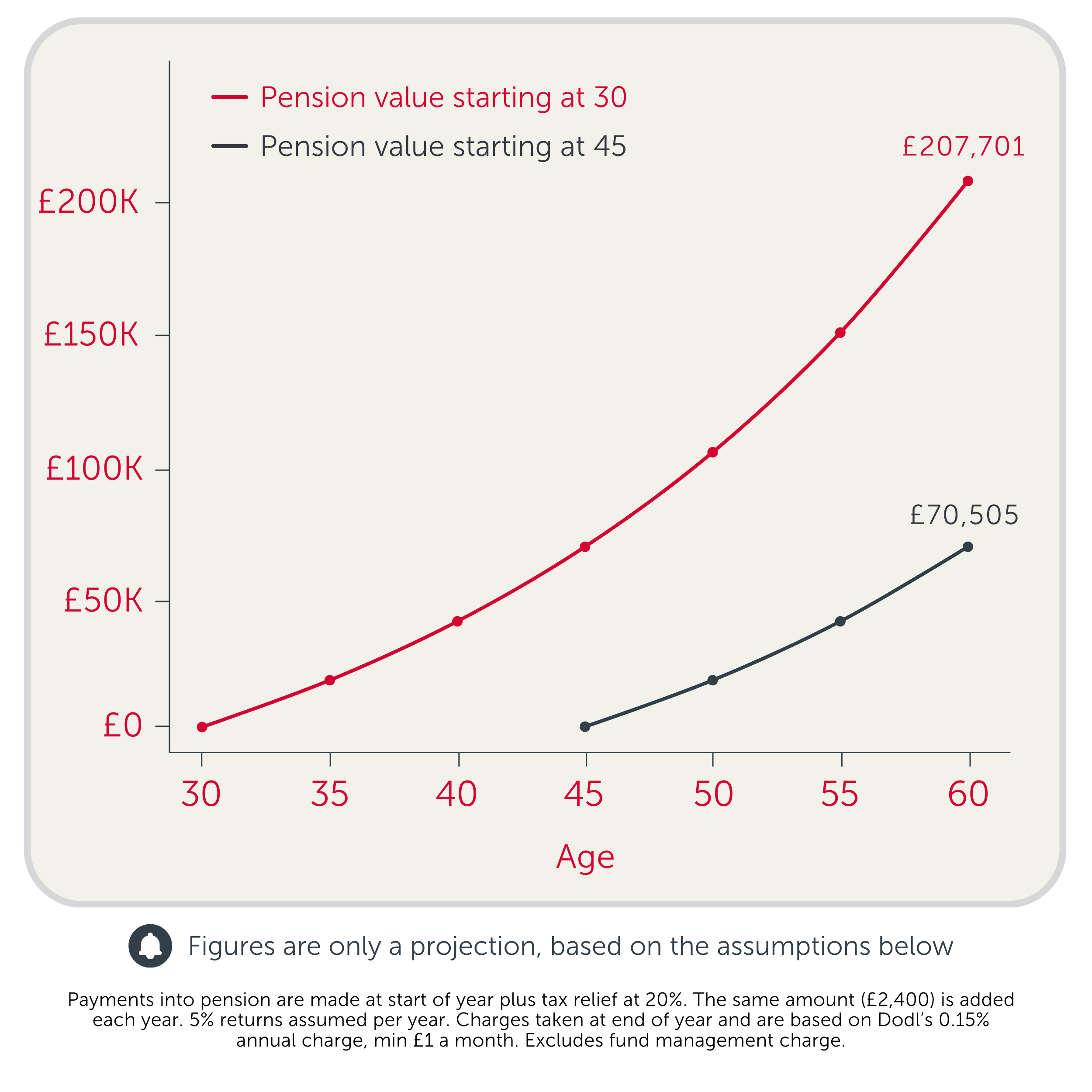

It's always a good idea to get a head start on saving for your retirement! The sooner you begin squirreling away money into your pension, the brighter your future will look. Self-invested pensions (like the Dodl pension) open up a whole world of investment opportunities. But here's the thing: which investments suit you best depends on how much risk you're comfortable with and how far away retirement is for you. 👴

The graph below puts into perspective the potential benefits of starting early.

Options at retirement

When it comes to accessing your pension, there are some pretty neat options available to you. You can start tapping into your pension pot from the age of 55 (or from 57 starting April 6, 2028), and here's the best part – you can take up to 25% of it tax-free! 💰

Plus, you have the flexibility to mix and match your choices, giving you some freedom in how you want to receive your income.

Taking income or lump sums

So, what's on the menu? You've got two main options: income drawdown or lump sums. With income drawdown or lump sums, you can keep the rest of your SIPP invested while enjoying some cash flow. 🏧

If you opt for income drawdown, you're basically letting your money work for you. Your income comes from the return generated by your investments, or by selling off some of your investments. Taking income from your pension means you're still riding the rollercoaster of market movements – could be thrilling or a bit nerve-wracking, depending on market conditions and what you’re invested in. 🎢

If you fancy taking it out in lump sums, you can opt to take the whole fund in one go, in smaller amounts and/or as a regular income. You can also get creative and mix and match your benefits! For example, you could withdraw half of your fund as a lump sum (25% tax-free, 75% taxed), and playing the long game with the other half, leaving it invested to give you the chance to be left with a juicy income down the road. 🛣

Annuities

With an annuity, you can ensure a steady stream of pension income throughout your lifetime. Here's how it works: you can purchase an annuity from an insurance company using some or all of your self-invested pension fund. The amount of income you receive depends on factors like your age, health, and lifestyle. 🏃♂️

But with an annuity, you don't have to stress about investment risks. That burden is taken off your shoulders and handled by the insurer, who guarantees to pay you a dependable income.

Now, let's address some common concerns. While annuities offer stability, they're not entirely risk-free. Over time, you may not receive the same amount back as you paid in, and your retirement income may not keep up with inflation unless you opt for an inflation-adjusted annuity. Also, if your annuity doesn't provide income after you've passed away, your beneficiaries won't receive anything. 😥

Understanding taxes on your pension benefits

When you're ready to retire, you can enjoy up to 25% of your pension as a tax-free lump sum – nice, right?

Now, the remaining portion of your pension is also yours to access, but any withdrawals you make beyond that initial 25% might be subject to income tax for the year. Just a heads-up, taking out too much could nudge you into a higher tax bracket, so it's worth considering. 🤔

Plus, it's essential to think about how long your pension needs to stretch and if it'll cover your expenses down the road. Before diving in, it's a good idea to chat with a financial advisor or check out the Government's Pension Wise service for some helpful guidance. You can reach Pension Wise at 0800 280 8880, or visit their site at www.moneyhelper.org.uk/pensionwise. 📲

What happens to your pension when you pass away?

If you happen to pass away before hitting 75, most of the time, your entire pension can be passed on to your loved ones without any pesky tax obligations. They can receive it either as a lump sum or as ongoing income, tax-free. 😁

Now, if you happen to live a little longer and pass away after the ripe age of 75, your pension can still be used to support your beneficiaries. However, it might be subject to a bit of tax. But hey, it's still a helpful way to provide for your loved ones even after you're gone. ❤

🔔 Always remember, the value of your investments can go down as well as up. Dodl doesn’t give advice, so if you’re unsure about investing, it’s always best to speak to a financial adviser. Tax treatment depends on your individual circumstances and rules may change. Pension rules apply.