Three key things to know about pensions

It’s Pension Awareness Week so there’s no better time to take a quick crash course on this very special type of investment account.

September marks many important dates: the end of summer, start of school…and Pension Awareness Week! Granted, it may not have the same significance as the first two – you may not have even heard of it - but Pension Awareness Week (PAW) is a big deal. It’s a chance to throw some light on pensions and spread the word about the importance of saving and investing for a comfortable and happy retirement. 🌅

So we took the opportunity to sit down with Tom Selby, AJ Bell’s very own pensions and retirement expert, and ask him to give us his three golden nuggets of knowledge every new investor should know about pensions. Here’s what he told us…

1. Free money on the table 🎉

If you have a workplace pension, you probably know that a small portion of your earnings will be going into this each month. But you may not know that your employer is also paying into it. That’s free money from your employer going straight towards your best life at retirement.

In fact, the government has set minimum levels of contributions for both you and your employer to add to your workplace pension. Just be aware though, the actual amounts paid in, and rules for how they’re figured out, will differ from pension to pension.

Why not do a little digging and find out how much you and your employer pay into your pension each month? 🕵️♀️

Another big win for paying into your pension is you get tax back for doing it! The government love to see us building up our retirement savings, so they give us tax relief on the amount we pay in. Lots of pension schemes will only claim back the basic amount, and just to remind you that’s 20%. So if you’re a higher earner, you may want to look into claiming your extra pension tax relief by completing a yearly tax return. 📝

Here’s a little example of how pension tax relief works.

Let’s say you pay in £80 into your pension from your salary each month, after tax. Your pension provider will then contact HMRC to claim basic rate tax relief on that amount, which is effectively a 25% bonus on the amount you paid in. That pushes your pension contribution up to a nice round £100! So that’s £20 free from the government just for saving into your pension. 💡

You can find out more about tax relief and how it works with Money Helper.

2. Investment growth is tax-free! 🙏

So, what happens to all that lovely money filling up your pension? Well, that’s where investments come in. Most pensions are invested in the stock market – whether that’s your workplace pension, where your investment options can be quite limited, or a self-invested personal pension (SIPP), where you’re in full control of what to invest in. The reason most pensions are invested is because, over time, investments can grow our money beyond what saving in cash can achieve. Making our retirement look a little rosier! 🌹

Pensions and investments are a perfect match. Pensions give investments the time and opportunity to really grow, as you can’t access them until 55 at the earliest (increasing to 57 from 2028). But, here’s the really great part. Any growth your pension’s investments build up, and any income they make, is tax free. Why? Because pensions are known as ‘tax wrappers’ in the personal finance world. It means that the investments held in them are protected from capital gains and dividend tax.

🔔 Just be aware, though pensions are super tax efficient, when you reach retirement, you’ll have to pay income tax on your pension withdrawals.

3. The earlier you start, the easier it is 💡

It’s hard enough to know what we want for dinner, let alone what we want our retirement to look like and how much money we’ll need to save to make that happen. But something you can be sure about is retirements are becoming more and more expensive. Recent research from the Pensions and Lifetime Savings Association found that a couple living a ‘comfortable’ retirement would need to bring in £55,000 a year between them. Bearing in mind that many people are now living off their retirement income for 20+ years, that’s a lot of pressure on your pension pots.

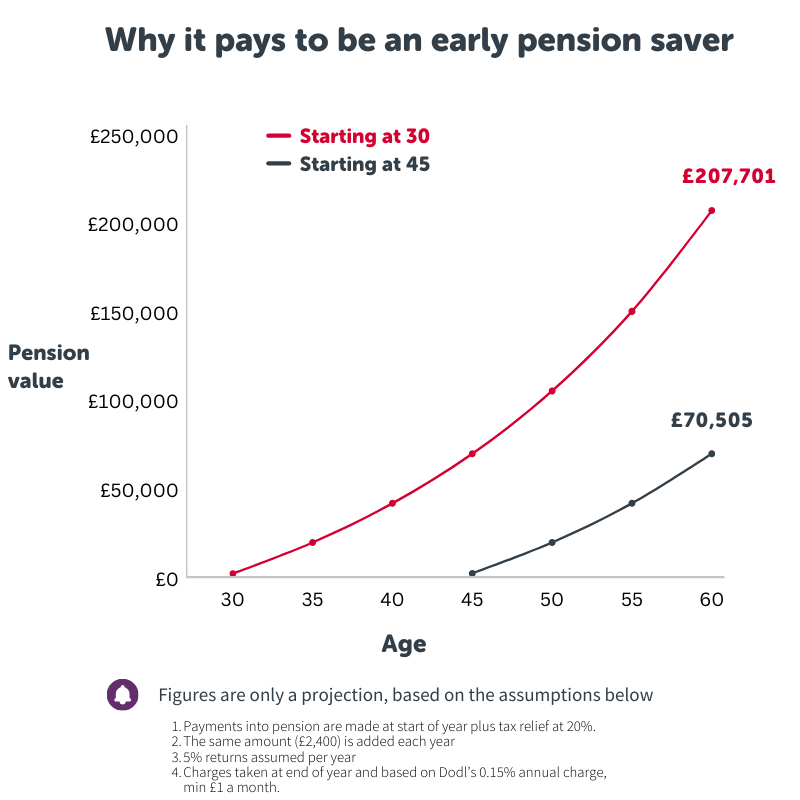

But there’s some good news, promise! The earlier you start the easier it is to build up enough savings to retire in glorious comfort. Take a look at this little graph we made earlier. We’ve used Dodl’s annual charge and a few assumptions to build the picture, but the general message is the same across pensions: getting started early can really pay off later.

Fired up and ready to become an early pension saver?!

Dodl has a simple self-invested pension you can get started with in less than 5 minutes. Find out more about it today. 👇

🔔 Remember this article, like all Dodl articles, is for your info only, and shouldn’t be taken as personal pension advice. Pension rules apply and can change in future and how you’re taxed depends on your own individual circumstances. Finally, the value of investments can change, and you could lose money as well as make it.