You don’t need to be rich to invest in an ISA

Crushing investing myths with Dodl

“You need to be rich to invest” is the OG finance myth. At Dodl, we’re all about highlighting the benefits and possibilities of investing, so what better way to crush that myth by showing what you can do with ISAs and just £25 per month. 💪

Use your allowance, your way ⭐

Just because ISAs come with a generous annual allowance, you don’t have to be able to put away the full £20,000 each tax year. The average amount paid into ISAs across the UK was less than £6,000 in the most recent stats from HMRC.

That’s still a lot of money at around £500 per month, and you shouldn’t worry if you’ve got less to put away. Many providers aim to make tax-free investing accessible – like Dodl’s investment ISA with a minimum investment of £25 per month.

While we’re on the subject of getting started, why not check out our getting ready to invest blog to get comfortable with the risks and putting away for a rainy day?

Tax-free investing 💸

Forget the headlines about yachts and dodgy schemes to try and beat the taxman, ISAs are a legit way to let you invest tax-free. You get to keep all your lovely ISA investment returns, as well as any sweet income (interest and/or dividends for the money nerds). 👓

These ISA tax benefits are more valuable than ever when many other allowances related to investing are being cut. For example, the amount you can earn (outside of ISAs and pensions) before paying dividend tax will be slashed down from the current £1,000 to £500 from 6 April. ✂

Any gains you make on investments outside of ISAs (and pensions) face similar cuts for the second year in a row. And to top it all off from 6 April, the capital gains allowance will go down to £3,000 for the year. So make the most of the ISA benefits while you can, because these allowance rule changes are coming in thick and fast. 🏎

Regular investing can keep you on track 🏃♂️

You don’t have to have a lump sum to get invested. Investing automatically on a regular basis brings blissful simplicity to your financial routine each month while also helping you smooth out the ups and downs of the market. 🎢

If your monthly buy happens when prices are lower, you’ll get more shares or units than before, or less if prices are higher this time around.

Lots of people also find regular investing helps them keep on track with their investment goals as it takes away the worry of when to pick the best time to invest a chunk of money. To quote a financial truth – “it’s about time in the market, not timing the market”. 🔮

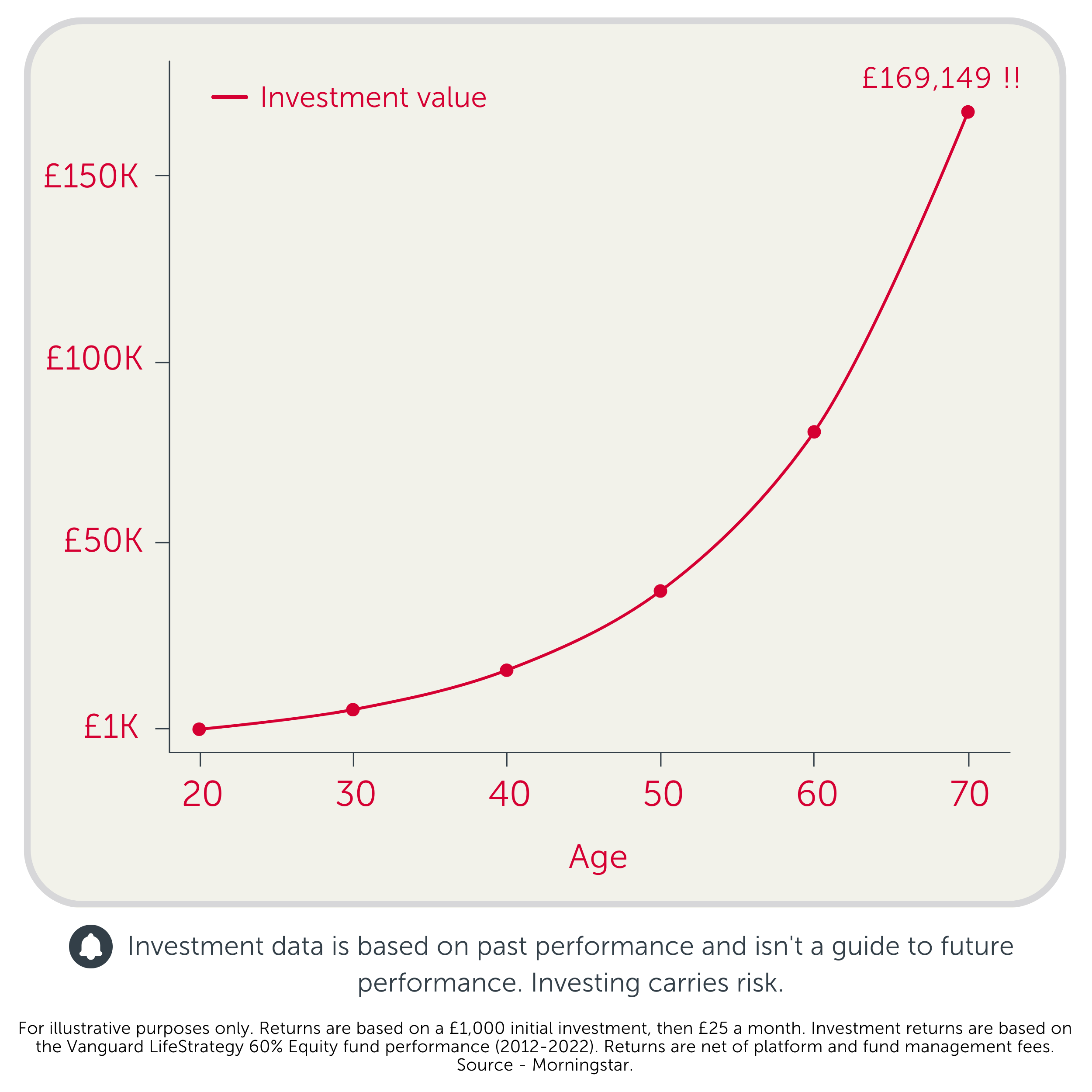

We crunched the numbers, and look at where investing just £25 a month can take you! It’s all about starting small, and thinking big... 💭

Moving existing investments to an ISA ↩

You can’t move existing investments straight into an ISA, but you can ask your provider to sell all or some of them, move the cash into an ISA and buy them back again. This is sometimes called ‘Bed and ISA’ and it helps you take advantage of the potential tax benefits of an investment ISA whilst keeping any investments you want to hold onto. 🛏

You’ll need to have enough ISA allowance left for the year to do this and it’s worth bearing in mind that the price you buy back won’t be the same as you sell due to market movements and UK stamp duty on some share purchases. There’s no charge to buy and sell investments with Dodl, but this might not be the case with other providers.

Also, keep in mind the allowance for tax-free gains if you think the investments you’re selling might’ve made you a tidy profit. 💸

A future ISA rule change could prove helpful

ISA rules mean you can currently only buy whole shares in individual companies, not a part or a fraction. But to buy a single share in some of the biggest US brands could cost you hundreds of dollars! 💰

The government plans to hold talks on changing the rules to allow fractions of certain shares to be held in ISAs, which could be good news if investing this way tickles your fancy.

Reckon the Dodl investment ISA might be for you?

🔔 Just remember, Dodl doesn’t give advice so we cannot tell you where to invest – you have to make all the decisions yourself. If you’re not comfortable doing this, it might be worth speaking to a qualified independent financial adviser about your options. The value of investments can change, meaning you could get back less than you originally invested.