New year, new… allowances!

A new tax year is fast approaching. Find out when it is and why it matters.

The current tax year is running out with 5 April marking the last day of the 2025/26 edition. It also marks the deadline for when you can use up certain allowances or claim some tax breaks before the new tax year starts on 6 April.

So, here’s your quick explainer on why the end of the tax year matters and a handy 5-point checklist to make sure you’re good and ready for it.

When does the new tax year begin?

In the UK the new tax year begins on 6 April. It may not receive as much fanfare as New Year’s Day but it’s worth popping in your diary. It’s the same date every year, no matter which day of the week it falls on – even if it falls on a bank holiday or weekend.

It also means that 5 April is the last day of the current tax year, and the last day you can use your current year’s tax allowances.

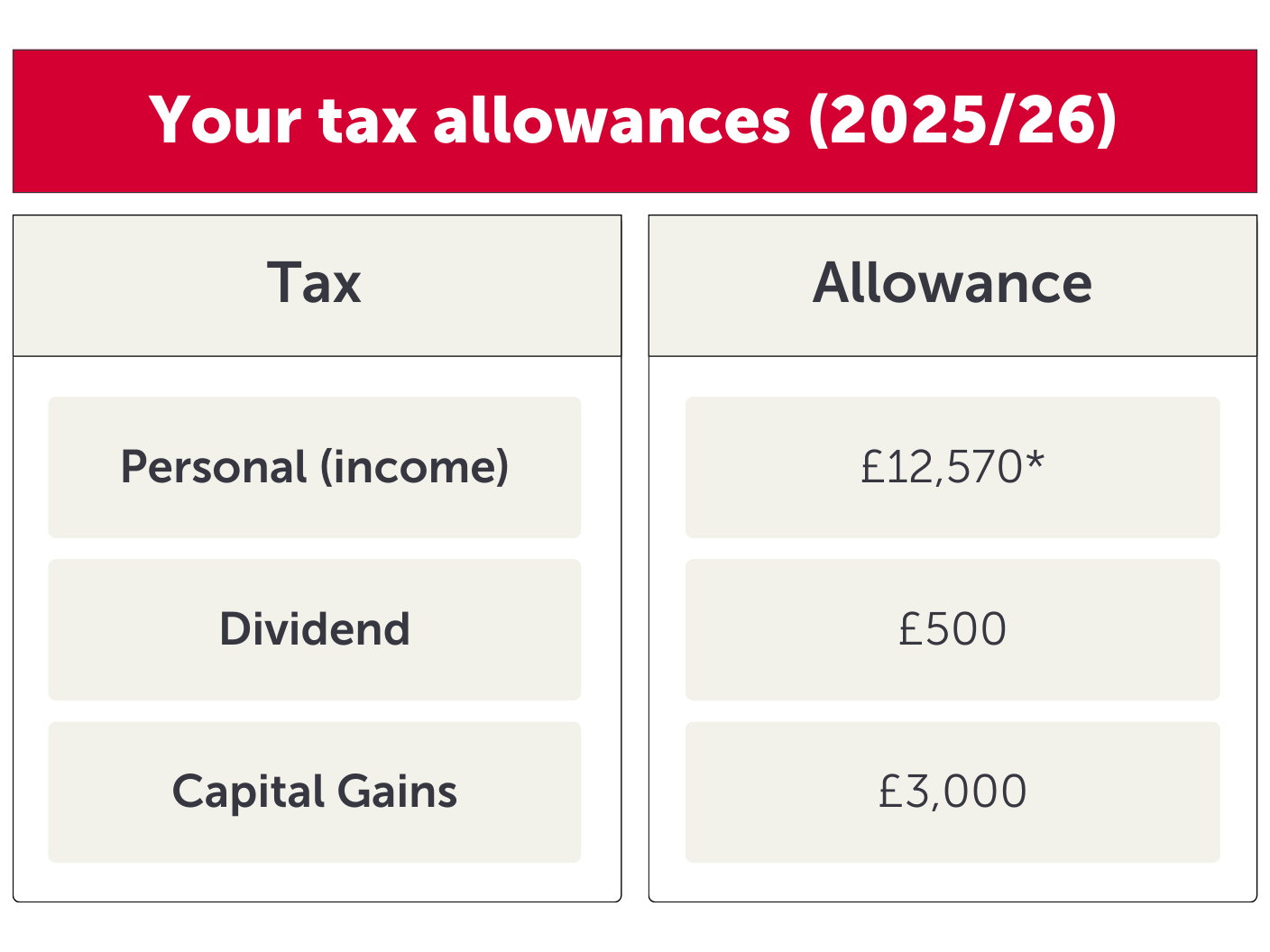

Your tax allowances are the amount you can earn tax-free every year, before you have to pay income, capital gains or dividend taxes. On 6 April, they reset for the new tax year.

If you go over your tax allowances you’ll have to pay some tax, and for dividends and capital gains that usually means contacting HMRC or completing a tax return so you can pay back the amount owed.

*For basic rate taxpayers. Personal income allowance reduces by £1 for every £2 of income above £100,000, with no personal allowance at £125,140 when additional rate tax kicks in.

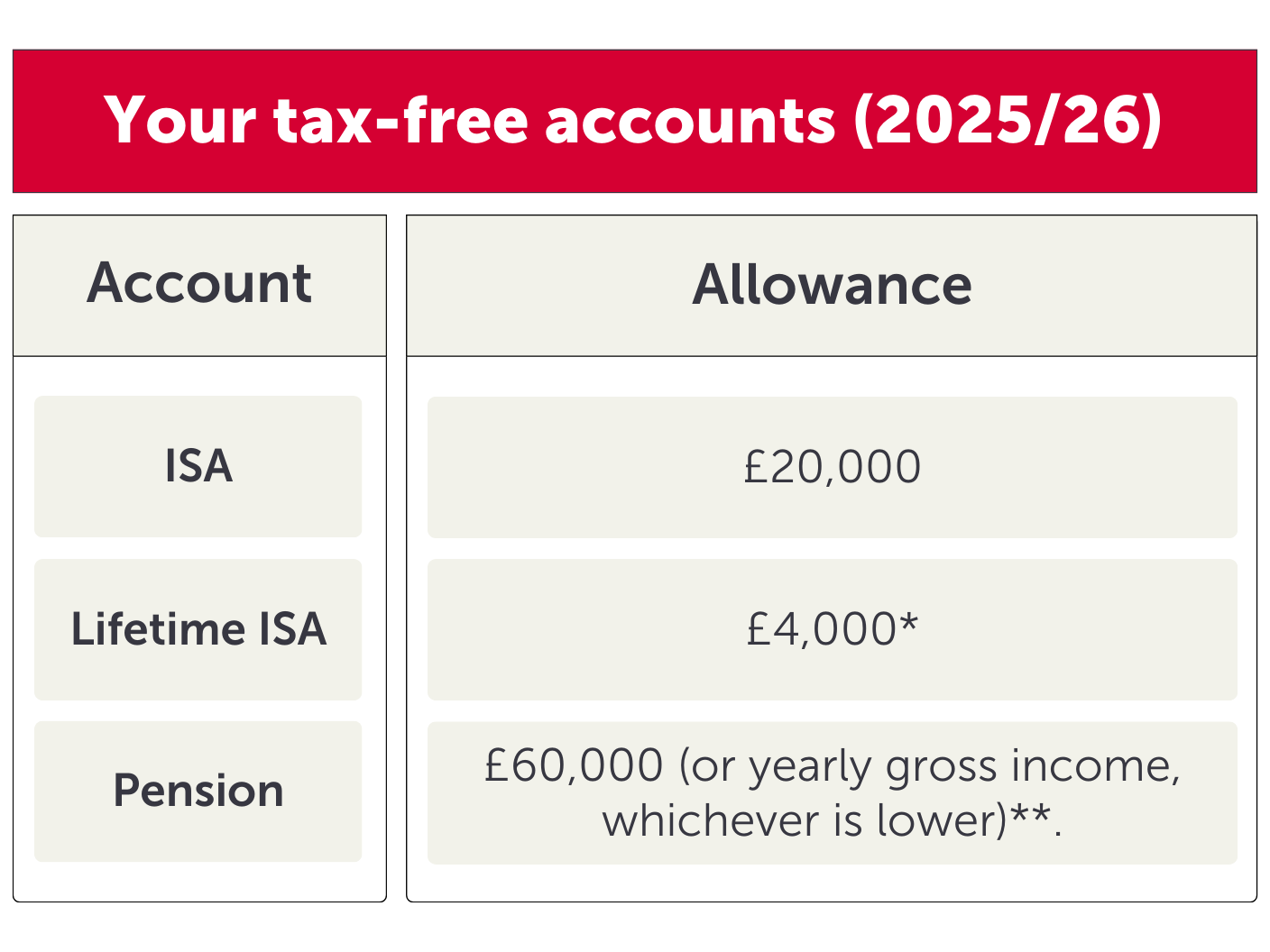

As well as the tax allowances resetting, your annual limits on how much you can save into your tax-efficient ISA and pension accounts resets. Keeping within the limits each year means whatever you pay into these types of accounts can be invested tax-free! That makes using these accounts some of the best ways to optimise your investments.

Something to bear in mind for ISAs (though not for pensions), is that the limit is use it or lose it. Once the new tax year begins, you say goodbye to any tax-free allowance you had remaining from the previous one. Note that this is the last year you will have the full £20,000 available to put in a cash ISA. Beginning April 2027, this amount will be reduced to £12,000.

For pensions, you can carry forward the £60,000 annual allowance for three years, as long as you were a member of a pension scheme during those years. You're still limited by your relevant UK earnings in that tax year.

*The £4,000 Lifetime ISA allowance is part of your overall £20,000 ISA allowance. So if you use it all, you’ll have £16,000 left of your ISA allowance you could use for another type of ISA. ISA rules apply.

**This includes the tax relief you get from the government and any contributions your employer makes. The pension allowance starts to taper once annual earnings reach £260,000 and stops once earnings exceed £360,000, when the taper will have reduced the annual allowance to £10,000. Pension rules apply.

To help you get ready to make the most of the new tax year, why not dive into our handy checklist and stay ahead of the game!

🔔 Investing is an opportunity to grow your money, typically outperforming cash savings over the long term. However, investing comes with risk as well as reward, and the value of your investments can go down as well as up. Tax benefits depend on your circumstances and tax rules may change. Any information we provide is to help with your research and isn't financial advice. Tax, ISA and pension rules apply and can change.