Solid Gold: another record-breaking run

Gold: always believes in its soul.

Gold has hit a new record high, breaking the $3,000 an ounce mark last week and still hovering around that level.

So, what’s driving gold prices up? Several factors are at play. Central banks are buying up large amounts of gold, and the US has seen big shipments ahead of new tariffs being introduced by President Trump. On top of that, stubbornly high inflation and concerns over rising government debt in both the US and UK are adding to the momentum.

This is now the third big gold price surge since 1971, when President Nixon took the US off the gold standard.

A look back at gold’s biggest bull runs

The first major surge happened in the 1970s. When Nixon removed the gold standard, it gave the US government more flexibility with spending, especially on the Vietnam War. But inflation soon shot up, driven by two major oil price shocks in 1973 and 1979. As a result, investors lost confidence in traditional assets like government debt and turned to gold, which saw massive price gains.

The second big rise took place in the early 2000s. A series of economic crises – including the dot-com bubble bursting and the Global Financial Crisis – led central banks to slash interest rates and pump money into the economy. This made some investors nervous that policymakers were losing control, pushing them toward gold once again.

The third and current surge has its roots in the last decade, when central banks kept interest rates at record lows and continued large-scale money printing. Then came the Covid pandemic, which left many governments struggling to manage soaring debts.

The US, in particular, has seen its federal debt skyrocket, leading to an annual interest bill of $1.2 trillion – over 20% of tax revenues. That’s a worrying figure, and it’s adding fuel to the fire for gold investors.

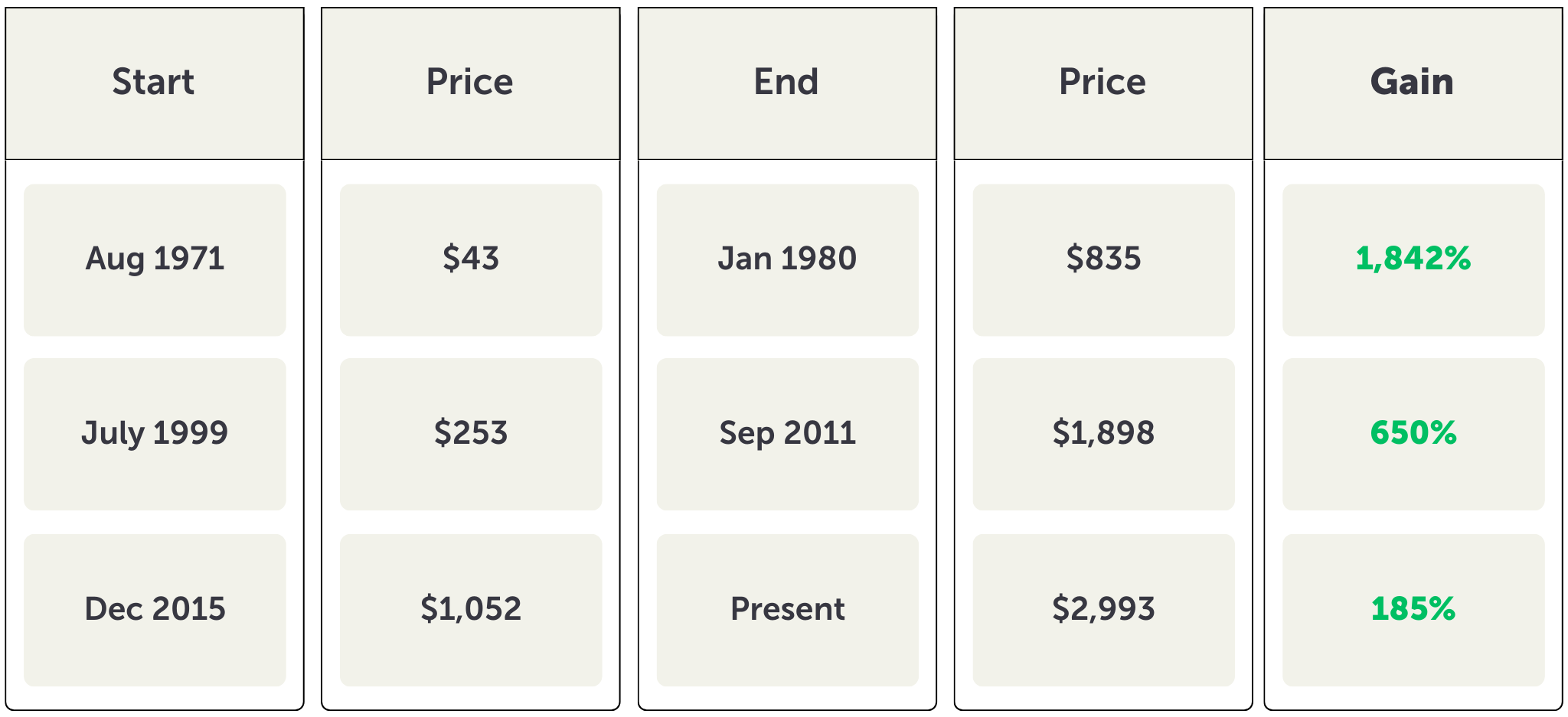

How much has gold risen in each bull run?

(Source: AJ Bell, LSEG)

Looking at these numbers, some gold investors believe there’s still room for further growth. The current rally hasn’t yet reached the heights of past surges.

What's next for gold?

Sceptics argue that previous gold price booms lasted around a decade, and this one is getting close to that mark. They also point to famous investor Warren Buffett’s view that gold has limited real-world use and doesn’t generate income like other investments.

That said, gold still appeals to many investors as a way to diversify their portfolios. If you’re considering investing in gold, there are different ways to do it. You can buy physical gold, invest in gold mining companies, or choose funds that track gold prices (like the ‘Going for gold’ fund on Dodl!).

Each option comes with its own risks and rewards, so it’s important to think about your investment goals and risk tolerance before jumping in.

🔔 Always remember, the value of your investments can go down as well as up. Dodl doesn’t give financial advice, but we do hope the info is helpful! Past performance is not an indicator of future performance.