This is when more interest rate cuts might happen

Rate cuts could be coming (but not just yet)

The Bank of England decided to keep interest rates on hold in June – but that might change once we head into Autumn.

With global tensions, rising oil prices and trade deadlines looming, it’s not too surprising the Bank hit pause and kept the base rate at 4.25% for now. But that doesn't mean it's game over for rate cuts this year.

What’s the hold-up?

Well, it’s safe to say things are a bit rocky out there. Conflict in the Middle East is pushing up oil prices, which could drive inflation. And with a key US tariff deadline landing on 9 July, the global economy’s got a few curveballs coming its way.

So, the Bank of England’s being cautious for now – but markets still reckon rate cuts are on the way, just a bit later than originally thought.

So, when might rates drop?

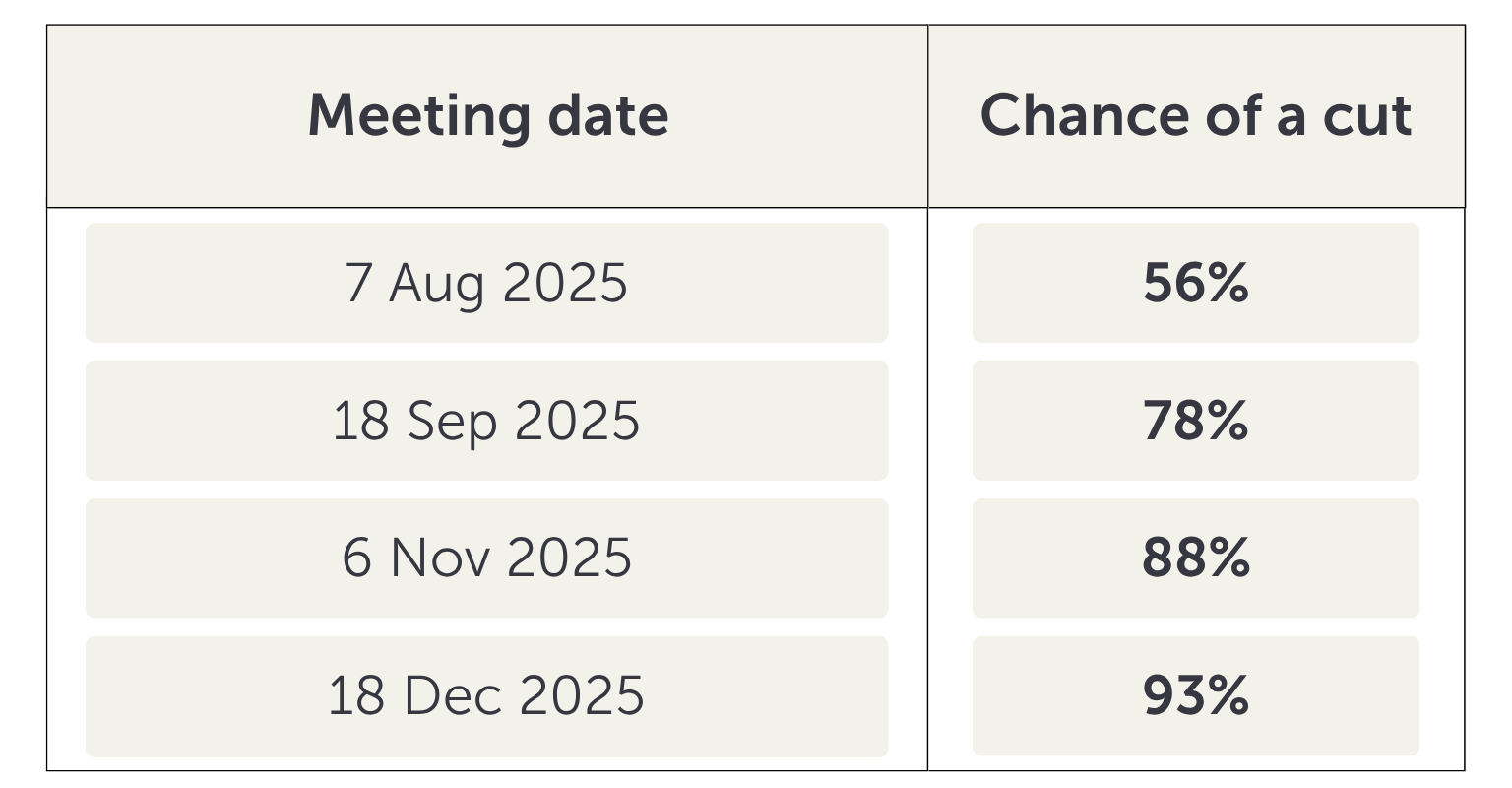

After the Bank’s latest meeting on 19 June, the odds of a rate cut this year actually went up. It’s thought that the hot dates to keep an eye on for a drop are 6 November and 18 December.

Basically, we might have to hang tight a little longer before seeing lower borrowing costs. Here’s a market view on future UK interest rate decisions.

Source: AJ Bell, LSEG

What did the Bank’s experts say?

The Bank’s interest rate decisions are made by a group called the Monetary Policy Committee (MPC) – there are nine members, and they vote at each meeting.

This time:

- 6 voted to keep rates the same

- 3 voted to cut them to 4%

So, they’re edging closer to a cut. Just two more votes next time and it could tip the balance.

What’s happening with mortgage rates?

Mortgage rates are still slowly sliding – mostly thanks to earlier rate cuts working their way through and some healthy competition between lenders.

This latest Bank of England decision probably won’t shake things up too much in the short term, but small cuts could still trickle through.

That said, the bigger picture, especially developments in the Middle East and US trade, could shift the outlook again, for better or worse.

And savings?

Savings rates are drifting down too. The average easy access account is now paying around 2.7%, which is actually less than inflation.

So after that burst of high rates, it might feel like a bit of a letdown.

Some people might be thinking about putting their money to work elsewhere, like investing, to try for better long-term returns. But whether you’re investing or not, it’s always wise to keep some cash set aside for emergencies.

🔔 Always remember, the value of your investments can go down as well as up. Dodl doesn’t give financial advice, but we do hope the info is helpful.