It’s your money – protect & grow it

How investing can be a savvy option when trying to beat the rising cost of living.

One of the main reasons we might choose to invest is to protect and grow our money for the future. 🚀 But protect it from what exactly? Big bad inflation is what. Here we explain what inflation is and how investing our spare cash can help us beat it.

What is inflation? 🤔

It’s the rate at which the cost of living increases. If inflation is going up, that means the cost of our daily essentials – food, energy, transport etc. – is going up. Put simply, £1 bought us more last month than it did this month, or our £’s ‘spending power’ is decreasing. But if inflation is going down (also called ‘deflation’), the cost of living will be decreasing (things are getting cheaper). So our £1 buys us more this month than it did last month.

The march of inflation: a froggy example 🐸

The cost of things generally goes up. If you had 10p in the early ‘00s, that’d buy you a delicious frog-shaped chocolate bar. Now...NOW!? Well, you’d need more than double that to get a look in. That’s why it’s not really a great idea to store our savings under the bed 🛌 – inflation will eat away at its value there. You want your savings’ growth to at least match inflation, if you want the ‘real value’ of your money to keep up i.e. that 10p would need to be worth 25p(!) now to buy that same delicious treat.

How is it measured?

There are a number of ways inflation rate is measured in the UK, but the main one is the Consumer Price Index (‘CPI’ if you will). It measures the average change in price of around 700 commonly bought goods and services, including food and fuel. The government’s Office for National Statistics (ONS) publish the CPI figures each month – for a good time, check them out.

For a handy tool to help you understand inflation and its effect on your money, have a play with the Bank of England’s inflation calculator.

Intro over, what can you do to beat inflation? 🥊

Inflation is important for all sorts of economic reasons, and worth keeping a close eye on. But the reason it features in this ‘Why invest?’ article is because investing has the potential to grow your £££, beating inflation over the long term. This means you could buy more with what you take out of your investments than what you put in!

A quick mention for cash savings 💰

Putting your cash into interest-paying savings accounts is another way you can try to protect your money from inflation. But the interest rate will need to match inflation rate if we want our savings to retain their real value. And it’ll need to beat inflation rate if we want what we take out to be worth more than we put in.

Interest rates for savings accounts are usually tied to the national interest rate (the ‘base rate’), set by the Bank of England. In 2021 the base rate dipped to historical lows of 0.1%, and interest rates for savings accounts followed, with rates dipping well below 1%. Though this may not always be the case, inflation rates have averaged 2.5% over the last 30 years, so interest rates on savings can sometimes feel a little…underwhelming. The conclusion: generally savings accounts don’t do a whole lot to protect the real value of our money, let alone increase it.

Dodl doesn’t offer savings accounts (not investments, not interested!), but most banks and building societies do if you decide that’s the route for you.

So, to investments! 📈

They’re not without their risks (which we cover in more detail in the risks article) but investments can offer better long-term returns than savings – and crucially, could also beat big bad inflation (woohoo!). This means that, by the time you take your money out of your investments, it *could* be worth more in real terms than when it went in. 💸

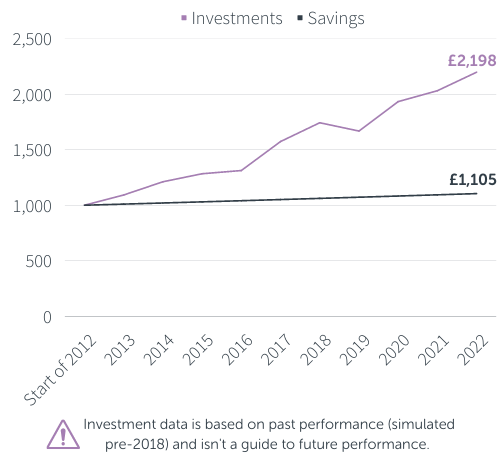

Here’s a nice graph we made earlier. It shows you how returns on savings and investments have compared over the past 10 years. You don’t need us to tell you (but we will): 🔔 past performance, like that shown in the graph, doesn’t predict future returns.

Graph provided for illustration purposes only. Data source: AJ Bell. Returns are based on £1,000 invested or saved at the start of 2012 and held there for ten years. Investment returns include Dodl account charge at minimum £1 per month and are based on the AJ Bell balanced fund performance where available (2018-2022) and its underlying asset allocation in all previous years to simulate its performance. Simulated performance (pre-2018) has been calculated using the current asset allocation which may have been different in the past and does not include fund charges. Investment returns shown exclusive of platform charges. Savings returns are based on an assumed average figure of 1% interest year on year.

It doesn’t take a mathematician to figure out that investments can bring us better returns on our cash than savings – and potentially much better.

But a very important caveat to choosing investments over savings is this: you have to be comfortable leaving your cash invested for the long term (a minimum of five years, but generally the longer the better). That’s because you’re more likely to see returns on your investments over time. The likelihood that you’ll see a return usually reduces as you shorten the time you invest for. So play it safe(r), and go long!

Feeling protective?? ☔

It is your money, so it’s worth giving some thought as to how to protect it from the effects of inflation. Savings accounts have their place (easy access to cash we need in the short-medium term), but if you want to give your cash the chance to grow and beat inflation, investing it for the long term is usually the way forwards. 👌 It’s said that the best day to start investing was yesterday, but today’s the next best!

🔔 Remember, investing carries risk and nothing in this article should be taken as advice - Dodl doesn't give advice, but we do hope the info is helpful!