Why you shouldn’t panic when markets fall…

Nervously tinkering with your portfolio during troubling market times? You might want to think twice!

Feeling anxious about your investments whenever the markets take a down-turn or when some bad news hits? It's understandable, but constantly adjusting your portfolio might actually do more harm than good.

We’ve said it before and we’ll say it again, investing is a marathon, not a sprint.

Market dips are just a part of the investment journey

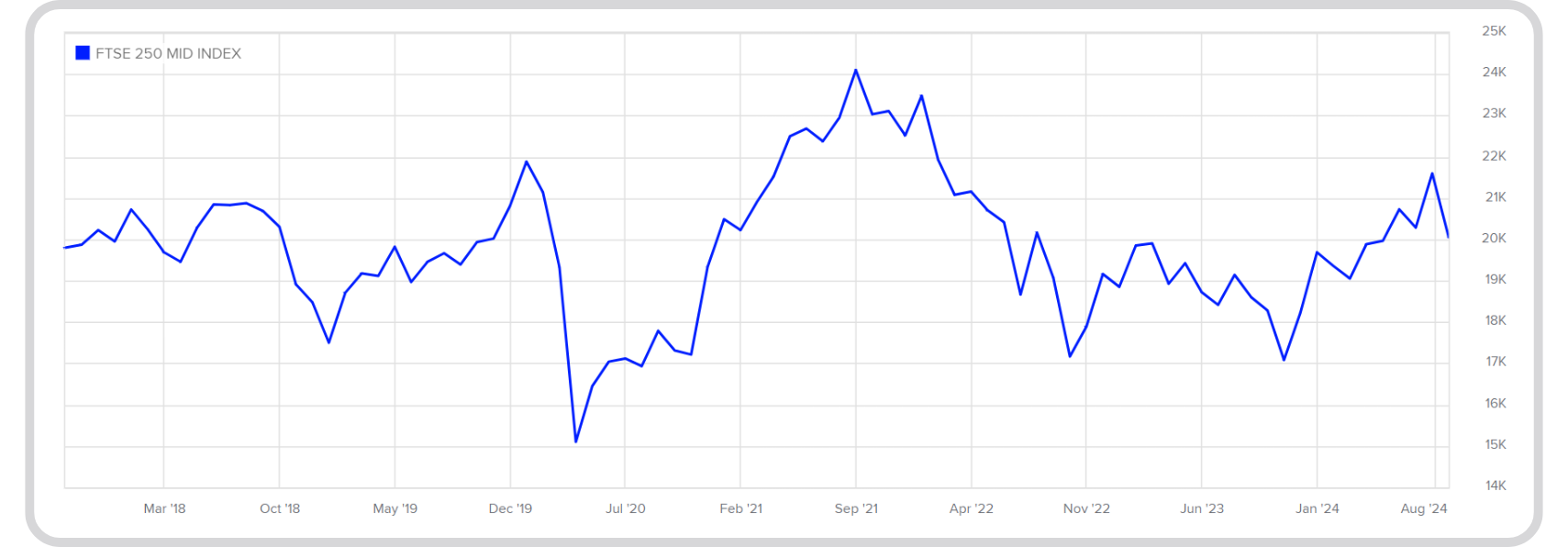

Just think about the rollercoaster we've been on in recent years. For example, when the pandemic hit and the world shut down, it was a bit like someone pulled the plug on the economy. The markets took a big dive as businesses struggled to cope. Check out the toll this took on the FTSE 100 (index of the 100 largest companies listed on the London stock exchange).

Source – London Stock Exchange

But guess what? Just like a rollercoaster, things eventually picked up. With time, vaccines, and a bit of economic magic, the FTSE 100 started to climb back up and within a year we were back up to pre-Covid levels and beyond! It wasn't a smooth ride, but it showed that even in tough times, things can turn around.

Aaand breathe…

The key is to stay calm and focused on the long term. If you’re always panic selling when things get tough, you could end up locking in losses and missing out on potential gains when things eventually improve.

Diversification is your best friend.

Spreading across different types of investments helps to cushion the blow when one area of the market isn't doing so well – some may rise, some may fall, but hopefully, they'll balance each other out over time.

Consider monthly investing

One way to take the stress out of investing is to set up regular investing. This means putting the same amount of money into your investments on the same day each month. It’s an automated process, so once you’ve set it up you won’t need to remember to invest your spare cash each month – your money is put to work for you, without you even lifting a finger.

By doing this, you don't have to worry about trying to time the market or making emotional decisions. You're simply committing to investing steadily, no matter what's happening. It's a great way to stay on track and calmly build your wealth over time.

Remember, you're investing for the future.

While it's tempting to chase the hottest stocks or jump ship when things get rocky, history has shown that staying invested through thick and thin can pay off. Many of today's successful investors have weathered multiple market storms.

If you're feeling unsure about your investment strategy, it's always a good idea to talk to a financial adviser. They can help you assess your risk tolerance and create a plan that aligns with your long-term goals.

So, take a deep breath, don’t think too deeply about the short-term noise, and trust in your investment plan. Your future self will thank you!

🔔 Investing is an opportunity to grow your money, typically outperforming cash savings over the long term. However, investing comes with risk as well as reward, and the value of your investments can go down as well as up. Tax benefits depend on your circumstances and tax rules may change. Any information we provide is to help with your research and isn't financial advice.